What is an

annual report?

annual report?

Annual report is a public document

issued by the company at the end of every financial year which contain the details of the company with respect to the business model, the financial

statements and many more. We will be breaking down “How to read annual report”

in much detail in this article.

issued by the company at the end of every financial year which contain the details of the company with respect to the business model, the financial

statements and many more. We will be breaking down “How to read annual report”

in much detail in this article.

Annual report is audited by the

independent auditors appointed in the annual general meeting and thus the

information provided in these documents is assumed to be “true and fair”. Any

discrepancies or misleading information in annual report is considered as a

severe offence which can go against the company.

independent auditors appointed in the annual general meeting and thus the

information provided in these documents is assumed to be “true and fair”. Any

discrepancies or misleading information in annual report is considered as a

severe offence which can go against the company.

Annual report is issued by the

company to the shareholders and other people who have interest in the company’s

business such as creditors, bankers, potential clients and shareholders, etc

(also known as stakeholder). Annual report of all the past financial years can

be found on the company’s website under the “investor relation” section. These

documents are very useful as it gives insights into the business and where does

the company stand as compared with its competitors.

company to the shareholders and other people who have interest in the company’s

business such as creditors, bankers, potential clients and shareholders, etc

(also known as stakeholder). Annual report of all the past financial years can

be found on the company’s website under the “investor relation” section. These

documents are very useful as it gives insights into the business and where does

the company stand as compared with its competitors.

Important

sections in an annual report:

sections in an annual report:

While annual reports are reliable and

trustworthy but certain companies try to manipulate it by adding a lot of

marketing content, which has no relevance and hence an individual investor

should be aware of what sections are relevant to him and should not fall for the marketing trap.

trustworthy but certain companies try to manipulate it by adding a lot of

marketing content, which has no relevance and hence an individual investor

should be aware of what sections are relevant to him and should not fall for the marketing trap.

In order to make this article more user

friendly, we will review the annual report of the company “Huhtamaki PPL Ltd.”

(You can download the same by clicking here)

friendly, we will review the annual report of the company “Huhtamaki PPL Ltd.”

(You can download the same by clicking here)

1. Financial Highlights

A company usually starts with disclosing

some important financial numbers such as revenue and profit for the year and

also introduces the investor with some of their most popular products of the

year, if any. It gives a fair understanding of the business products and how

well they performed with respect to sales, profit and market share.

some important financial numbers such as revenue and profit for the year and

also introduces the investor with some of their most popular products of the

year, if any. It gives a fair understanding of the business products and how

well they performed with respect to sales, profit and market share.

Below is the snapshot of Financial

highlights from Huhtamaki PPL (AR Pg. 20)

highlights from Huhtamaki PPL (AR Pg. 20)

2.

Director’s

letter to shareholder

This section tells us about the decisions made by the company in the previous

financial year and their impact in the future. The director conveys his message

about the company’s vision, performance, projects and much more with the

shareholders.

financial year and their impact in the future. The director conveys his message

about the company’s vision, performance, projects and much more with the

shareholders.

Below is

the snapshot of Director letters from Huhtamaki PPL (AR Pg. 22)

the snapshot of Director letters from Huhtamaki PPL (AR Pg. 22)

3.

Management

discussion and analysis (MD&A)

This is

one of the most important section as it gives the overall picture of the

company. The section usually starts with an introduction and business model of the

company. It gives detailed information about the industry in which the company

operates and the growth outlook for the overall industry. If the company

operates in the international market, the section would also mention the global

economic outlook which can impact the industry. It talks about all the recent

developments, exports, initiatives, tax implications, development of the

economy, risk in the business, etc.

one of the most important section as it gives the overall picture of the

company. The section usually starts with an introduction and business model of the

company. It gives detailed information about the industry in which the company

operates and the growth outlook for the overall industry. If the company

operates in the international market, the section would also mention the global

economic outlook which can impact the industry. It talks about all the recent

developments, exports, initiatives, tax implications, development of the

economy, risk in the business, etc.

(This section teaches a lot of stuff which an

investor need, it is so powerful that if we read this section of three to four

companies who are in the same industry then we could be an expert of that

industry.)

investor need, it is so powerful that if we read this section of three to four

companies who are in the same industry then we could be an expert of that

industry.)

Below is

the snapshot of MD&A from

Huhtamaki PPL (AR Pg. 22)

the snapshot of MD&A from

Huhtamaki PPL (AR Pg. 22)

Also, Check out Most Recommended Finance Books by World Leaders

4.

Corporate

Information

These

section gives detail about the company’s key managerial personnels, bankers,

auditors, registered offices and headquarter address, research and development

centres, etc. It also provides information about the subsidiaries and the company’s

share of interest in those subsidiaries. (You may also check the corporate

governance section to get detailed information about the promoters and board of

directors)

section gives detail about the company’s key managerial personnels, bankers,

auditors, registered offices and headquarter address, research and development

centres, etc. It also provides information about the subsidiaries and the company’s

share of interest in those subsidiaries. (You may also check the corporate

governance section to get detailed information about the promoters and board of

directors)

Below is

the snapshot of Corporate Information from Huhtamaki PPL (AR Pg. 125)

the snapshot of Corporate Information from Huhtamaki PPL (AR Pg. 125)

5.

Shareholding

pattern

This

section discloses the total shareholding of Promoters, Domestic

Institutional Investors (DII), Foreign Institutional Investors (FII), Retail

investors and others. (Lower promoter’s shareholding is a sign of concern.)

section discloses the total shareholding of Promoters, Domestic

Institutional Investors (DII), Foreign Institutional Investors (FII), Retail

investors and others. (Lower promoter’s shareholding is a sign of concern.)

Below is

the snapshot of Shareholding pattern from Huhtamaki PPL (AR Pg. 65)

the snapshot of Shareholding pattern from Huhtamaki PPL (AR Pg. 65)

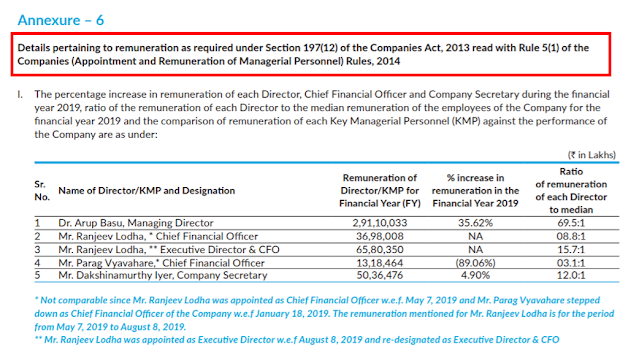

6.

Remuneration

of directors and key managerial personal

This

section tells us about the remuneration/salary paid to the directors and KMP

and also let us know what is the ceiling as per the act for the salary payment,

basically, the ceiling set by companies act is 10% of net profit, usually the

company’s pay salary around 4 to 5% of net profit. It also talks about the

amount paid to the board of directors and committee members for attending board

meetings, it should not be too high which could indicate something fishy going

on in the company. (For example, One crore per meeting is not justifiable)

section tells us about the remuneration/salary paid to the directors and KMP

and also let us know what is the ceiling as per the act for the salary payment,

basically, the ceiling set by companies act is 10% of net profit, usually the

company’s pay salary around 4 to 5% of net profit. It also talks about the

amount paid to the board of directors and committee members for attending board

meetings, it should not be too high which could indicate something fishy going

on in the company. (For example, One crore per meeting is not justifiable)

Below is

the snapshot of Remuneration from Huhtamaki PPL (AR Pg. 51)

the snapshot of Remuneration from Huhtamaki PPL (AR Pg. 51)

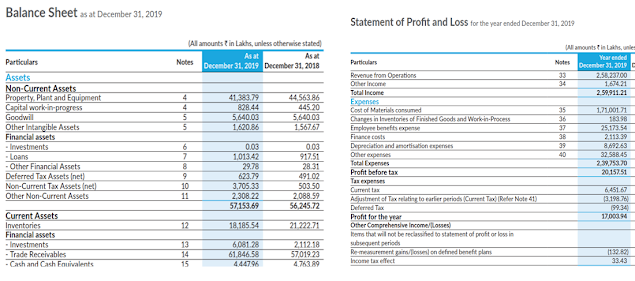

7.

The

Financial Statement

Last but

not the least, the financial information is one of the most important and

crucial aspect of any business and is very important to analyse this section.

It contains three financial statements:-

not the least, the financial information is one of the most important and

crucial aspect of any business and is very important to analyse this section.

It contains three financial statements:-

a. The profit and loss statement

b. The balance sheet

c. The cash flow statement

If the company has multiple subsidiaries and all of

them are into the same business then one should look at the consolidated

financial statement and if the company does not have any subsidiary or have

subsidiary but they are into some different businesses than in such case one

should look at standalone financial statements.

them are into the same business then one should look at the consolidated

financial statement and if the company does not have any subsidiary or have

subsidiary but they are into some different businesses than in such case one

should look at standalone financial statements.

Keeping the above point in mind we should always

analyse the consolidated figures as it gives the overall picture of the

company’s business. In our next article, we will be discussing in detail about

all the three financial statements and how to understand which line items are

the most important and what are the signs of a fundamentally strong company?

analyse the consolidated figures as it gives the overall picture of the

company’s business. In our next article, we will be discussing in detail about

all the three financial statements and how to understand which line items are

the most important and what are the signs of a fundamentally strong company?

Below is the snapshot of Financial statements from

Huhtamaki PPL (AR Pg. 84)

Huhtamaki PPL (AR Pg. 84)

8.

Contingent

liabilities and commitment

These are

the liabilities which might or might not occur in the future. For example, If there is some ongoing lawsuit against the company, and if lost, the company might have to pay a huge chunk of penalty,

income tax dues, sales tax dues, etc. Such liabilities are not shown on the balance sheet. They have a separate segment to disclose contingencies.

the liabilities which might or might not occur in the future. For example, If there is some ongoing lawsuit against the company, and if lost, the company might have to pay a huge chunk of penalty,

income tax dues, sales tax dues, etc. Such liabilities are not shown on the balance sheet. They have a separate segment to disclose contingencies.

These are some of the important sections

one should keep in mind while analysing or reading an annual report. There are different perspectives of every individual to look at it. This was just an

overall and a simplistic example on “How to read annual report”. The more you

read the more you understand, as I have mentioned above pick up an industry and

try to read the annual reports of different companies of the same industry, as

you will move forward there will be lots and lots of learning and eventually, you would be able to pick up the best companies. Each of the sections will be

covered in detail and we will let you know how to analyse the above sections part

by part in our upcoming “Fundamental Analysis Series”. (We will attach the links as and when

updated)

one should keep in mind while analysing or reading an annual report. There are different perspectives of every individual to look at it. This was just an

overall and a simplistic example on “How to read annual report”. The more you

read the more you understand, as I have mentioned above pick up an industry and

try to read the annual reports of different companies of the same industry, as

you will move forward there will be lots and lots of learning and eventually, you would be able to pick up the best companies. Each of the sections will be

covered in detail and we will let you know how to analyse the above sections part

by part in our upcoming “Fundamental Analysis Series”. (We will attach the links as and when

updated)

Till then don’t forget to check our most popular post “12 Pointers Checklist to pick a Multibagger Stock”.

Check out our popular articles:

If you found this article useful then do comment your questions or view in the comment box below, and share it with all your family

and friends. Lets spread financial literacy together.

and friends. Lets spread financial literacy together.

Thanks for reading.

– The Finance Magic

Thank you for sharing. This article is now saved in my bookstore.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/hu/register-person?ref=FIHEGIZ8

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.info/register?ref=P9L9FQKY

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Разве я похож на слабоумного? – О да, ты не похож на слабоумного, – тихо ответил прокуратор и улыбнулся какой-то страшной улыбкой, – так поклянись, что этого не было. раскрутить сайт самому Опасения Ивана Николаевича полностью оправдались: прохожие обращали на него внимание и оборачивались.

– Слишком много ты жаловался кесарю на меня, и настал теперь мой час, Каифа! Теперь полетит весть от меня, да не наместнику в Антиохию и не в Рим, а прямо на Капрею, самому императору, весть о том, как вы заведомых мятежников в Ершалаиме прячете от смерти. взять микрокредит Кстати, скажи: верно ли, что ты явился в Ершалаим через Сузские ворота верхом на осле, сопровождаемый толпою черни, кричавшей тебе приветствия как бы некоему пророку? – тут прокуратор указал на свиток пергамента.

Однако повезло не так уж, как бы нужно было! На Ивана пахнуло влажным теплом, и, при свете углей, тлеющих в колонке, он разглядел большие корыта, висящие на стене, и ванну, всю в черных страшных пятнах от сбитой эмали. разместить статью ссылкой Поэт провел рукою по лицу, как человек, только что очнувшийся, и увидел, что на Патриарших вечер.

От этого он до того обезумел, что, упавши на скамью, укусил себя за руку до крови. Ремонт пластиковых окон в Ясенево Сидящие на стульях, и на столах, и даже на двух подоконниках в комнате Правления МАССОЛИТа серьезно страдали от духоты.

– Видите ли, профессор, – принужденно улыбнувшись, отозвался Берлиоз, – мы уважаем ваши большие знания, но сами по этому вопросу придерживаемся другой точки зрения. бюро переводов с нотариальным заверением рядом Было около десяти часов утра.

У этой двери также была очередь, но не чрезмерная, человек в полтораста. нотариус Бунинская аллея Только сейчас он был уже не воздушный, а обыкновенный, плотский, и в начинающихся сумерках Берлиоз отчетливо разглядел, что усишки у него, как куриные перья, глазки маленькие, иронические и полупьяные, а брючки клетчатые, подтянутые настолько, что видны грязные белые носки.

Не бей меня. нотариус Боярская Швейцар, вышедший в этот момент из дверей ресторанной вешалки во двор, чтобы покурить, затоптал папиросу и двинулся было к привидению с явной целью преградить ему доступ в ресторан, но почему-то не сделал этого и остановился, глуповато улыбаясь.

маркетплейс аккаунтов гарантия при продаже аккаунтов

Те сконфузились. Облицовка фар Иван увидел серый берет в гуще в начале Большой Никитской, или улицы Герцена.

купить аккаунт маркетплейс для реселлеров

маркетплейс аккаунтов платформа для покупки аккаунтов

Во втором кресле сидел тот самый тип, что померещился в передней. дизайн ванной комнаты – Пиво есть? – сиплым голосом осведомился Бездомный.

покупка аккаунтов продажа аккаунтов

аккаунт для рекламы аккаунты с балансом

биржа аккаунтов маркетплейс аккаунтов

маркетплейс аккаунтов продажа аккаунтов соцсетей

Account Market Profitable Account Sales

Verified Accounts for Sale Purchase Ready-Made Accounts

Buy and Sell Accounts Find Accounts for Sale

Account Selling Service Account Market

Accounts marketplace Sell Pre-made Account

Sell accounts Buy Pre-made Account

Secure Account Purchasing Platform Purchase Ready-Made Accounts

Account Selling Platform Sell Account

Social media account marketplace Account Market

Account market Account Trading Platform

account exchange service accounts for sale

social media account marketplace account buying service

secure account purchasing platform account buying platform

gaming account marketplace account catalog

account purchase account purchase

account buying service social media account marketplace

account store gaming account marketplace

purchase ready-made accounts buy pre-made account

account exchange sell accounts

account purchase account buying platform

ready-made accounts for sale account market

social media account marketplace gaming account marketplace

website for selling accounts account sale

buy accounts account exchange

website for buying accounts account market

account catalog purchase ready-made accounts

buy and sell accounts sell accounts

online account store profitable account sales

verified accounts for sale account exchange service

account exchange find accounts for sale

account sale account trading service

account exchange service sell account

gaming account marketplace account store

accounts market sell accounts

account trading platform buy account

account buying platform sell accounts

database of accounts for sale accounts market

account exchange service https://accounts-offer.org

marketplace for ready-made accounts https://accounts-marketplace.xyz

account store account marketplace

account exchange https://social-accounts-marketplaces.live

account catalog https://accounts-marketplace.live

account market https://social-accounts-marketplace.xyz

account catalog https://buy-accounts.space

buy account account marketplace

social media account marketplace accounts market

account exchange service accounts marketplace

account market https://social-accounts-marketplace.live

gaming account marketplace https://accounts-marketplace-best.pro

продать аккаунт akkaunty-na-prodazhu.pro

продажа аккаунтов https://rynok-akkauntov.top

биржа аккаунтов https://kupit-akkaunt.xyz

маркетплейс аккаунтов https://akkaunt-magazin.online/

маркетплейс аккаунтов https://akkaunty-market.live/

маркетплейс аккаунтов https://kupit-akkaunty-market.xyz

магазин аккаунтов https://akkaunty-optom.live/

площадка для продажи аккаунтов https://online-akkaunty-magazin.xyz/

площадка для продажи аккаунтов https://akkaunty-dlya-prodazhi.pro

продать аккаунт kupit-akkaunt.online

buy facebook ads account https://buy-adsaccounts.work

buy facebook account for ads https://buy-ad-accounts.click

facebook accounts for sale https://buy-ad-account.top

facebook accounts for sale https://buy-ads-account.click

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/join?ref=P9L9FQKY

buying facebook account https://ad-account-buy.top

buy facebook accounts https://buy-ads-account.work

buy fb account https://ad-account-for-sale.top/

facebook accounts for sale https://buy-ad-account.click

facebook ad accounts for sale buy fb ad account

google ads agency accounts sell google ads account

buy old google ads account https://buy-ads-accounts.click

buy facebook ad account https://buy-accounts.click

google ads account seller https://ads-account-for-sale.top/

buy google ad threshold account https://ads-account-buy.work/

buy google ads threshold account buy google ads

buy google agency account https://buy-account-ads.work

buy verified google ads accounts https://buy-ads-agency-account.top

google ads account for sale https://sell-ads-account.click

Your article helped me a lot, is there any more related content? Thanks!

buy google ads threshold account buy account google ads

Если второй, явно сумасшедший человек, повинен в произнесении нелепых речей, смущавших народ в Ершалаиме и других некоторых местах, то первый отягощен гораздо значительнее. бюро переводчик рядом Иван оборвал пуговицы с кальсон там, где те застегивались у щиколотки, в расчете на то, что, может быть, в таком виде они сойдут за летние брюки, забрал иконку, свечу и спички и тронулся, сказав самому себе: – К Грибоедову! Вне всяких сомнений, он там.

– Что слышу я, прокуратор? – гордо и спокойно ответил Каифа. продвижение сайта в яндексе директ самостоятельно Тут иностранец отколол такую штуку: встал и пожал изумленному редактору руку, произнеся при этом слова: – Позвольте вас поблагодарить от всей души! – За что это вы его благодарите? – заморгав, осведомился Бездомный.

facebook business manager buy buy-business-manager.org

buy google adwords accounts buy verified google ads account

И вот теперь редактор читал поэту нечто вроде лекции об Иисусе, с тем чтобы подчеркнуть основную ошибку поэта. wordpress пошаговая инструкция создания сайта Так ты утверждаешь, что не призывал разрушить… или поджечь, или каким-либо иным способом уничтожить храм? – Я, игемон, никого не призывал к подобным действиям, повторяю.

buy facebook verified business manager https://buy-bm-account.org/

buy verified business manager https://buy-verified-business-manager-account.org/

buy facebook business manager buy-verified-business-manager.org

unlimited bm facebook https://buy-business-manager-acc.org

«Он не иностранец… он не иностранец… – думал он, – он престранный субъект… но позвольте, кто же он такой?. бюро переводов паспортов нотариальный «Что же это такое, – подумал он, – уж не схожу ли я с ума? Откуда ж эти отражения?!» Он заглянул в переднюю и испуганно закричал: – Груня! Какой тут кот у нас шляется? Откуда он? И кто-то еще с ним?! – Не беспокойтесь, Степан Богданович, – отозвался голос, но не Груни, а гостя из спальни, – кот этот мой.

Да горе в том, что спросить-то было некому. перевод документов с молдавского на русский нотариальным заверением Но он тотчас же подавил его своею волею и вновь опустился в кресло.

Никому не известно, какая тут мысль овладела Иваном, но только, прежде чем выбежать на черный ход, он присвоил одну из этих свечей, а также и бумажную иконку. нотариальный перевод паспорта с молдавского на русский Регент с великою ловкостью на ходу ввинтился в автобус, летящий к Арбатской площади, и ускользнул.

– Если бы с ним поговорить, – вдруг мечтательно сказал арестант, – я уверен, что он резко изменился бы. джет мани микрофинанс официальный сайт телефон «Увидели меня», – подумал прокуратор.

facebook business manager buy business-manager-for-sale.org

buy facebook bm account buy-business-manager-verified.org

buy verified bm buy-bm.org

Сидящие на стульях, и на столах, и даже на двух подоконниках в комнате Правления МАССОЛИТа серьезно страдали от духоты. bmw e34 замена воздушного фильтра На маленькой головке жокейский картузик, клетчатый кургузый воздушный же пиджачок… Гражданин ростом в сажень, но в плечах узок, худ неимоверно, и физиономия, прошу заметить, глумливая.

– Милиция? – закричал Иван в трубку. воздушный фильтр для двигателя honda gx 390 Бас сказал безжалостно: – Готово дело.

Берлиоз говорил, а сам в это время думал: «Но, все-таки, кто же он такой? И почему он так хорошо говорит по-русски?» – Взять бы этого Канта, да за такие доказательства года на три в Соловки! – совершенно неожиданно бухнул Иван Николаевич. джет мани контакт Вот только дама, которую Степа хотел поцеловать, осталась неразъясненной… черт ее знает, кто она… кажется, в радио служит, а может быть, и нет.

buy verified business manager facebook https://verified-business-manager-for-sale.org/

facebook bm account https://buy-business-manager-accounts.org

tiktok ads agency account https://buy-tiktok-ads-account.org

tiktok ads account for sale https://tiktok-ads-account-buy.org

– Неужели ты скажешь мне, что все это, – тут первосвященник поднял обе руки, и темный капюшон свалился с головы его, – вызвал жалкий разбойник Вар-равван? Прокуратор тыльной стороной кисти руки вытер мокрый, холодный лоб, поглядел в землю, потом, прищурившись, в небо, увидел, что раскаленный шар почти над самой его головою, а тень Каифы совсем съежилась у львиного хвоста, и сказал тихо и равнодушно: – Дело идет к полудню. pay ps займ вход в личный кабинет – Ах так?! – дико и затравленно озираясь, произнес Иван.

Но, помилуйте меня, философ! Неужели вы, при вашем уме, допускаете мысль, что из-за человека, совершившего преступление против кесаря, погубит свою карьеру прокуратор Иудеи? — Да, да, — стонал и всхлипывал во сне Пилат. регулировка окна в москве Значит, это жрецы или их помощники.

Отрабатывая произношение, Славка понял, зачем понадобился Меру диктофон. замена уплотнителя на пластиковых окнах цена челябинск Идём быстро, без запаса.

– Руська, что ты, на самом деле! Нашла время для вязания! Кикимора и голой до болота добежит, а как этих вытащить? Одноклассница огрызнулась, не отрываясь от ремонта на кикиморе: – Я что, знаю? Были бы носилки, как у мамы на скорой – другое дело… – Ой, тупые мы, – завопил Славка, вскакивая. пластиковые окна саламандра ремонт в москве К диким третий отряд присоединился, идёт за нами.

buy tiktok ads accounts https://tiktok-ads-account-for-sale.org

buy tiktok ads accounts https://tiktok-agency-account-for-sale.org

buy tiktok business account https://buy-tiktok-ad-account.org

Но эту комнату не занимать, постельное белье можно не менять. сетки москитные на пластиковые окна волжский Священную дорогу, хотя бы… Славка просиял, пообещал: – «Как же! В лучшем виде!» И тотчас потребовал у Олена, чтобы тот дал Русане то самое, быстрое понимание чужого языка.

Призраки попробовали просочиться сквозь защиту мальчишек. москитные сетки на пластиковые окна белгород Из первого подъезда выбежал швейцар, поглядел вверх, немного поколебался, очевидно, не сообразив сразу, что ему предпринять, всунул в рот свисток и бешено засвистел.

tiktok agency account for sale https://buy-tiktok-ads-accounts.org

— О нет! — воскликнула Маргарита, поражая проходящих, — согласна на все, согласна проделать эту комедию с натиранием мазью, согласна идти к черту на куличики. москитные сетки антикошка заказать Эта мысль потянула за собою воспоминание о гибели Берлиоза, но сегодня оно не вызвало у Ивана сильного потрясения.

buy tiktok ads accounts https://tiktok-ads-agency-account.org

tiktok ads account for sale tiktok agency account for sale

tiktok ads account buy https://buy-tiktok-ads.org

Славка левой рукой осторожно распахнул корочку. Оставил раскрытую страницу подсыхать. Действительно, это была Мелюковка, и на подъезд выбежали девки и лакеи со свечами и радостными лицами.

Вимана стояла на берегу широкой водной глади. Вода тут славная, можешь купаться. – Ой, мама, я же вся изодралась, а вы молчите! Свиньи, всё бы надо мной ржать, – расстроилась и рассердилась Русана, обнаружив непорядок в одежде.

Тимура уже отпустили, тот отряхивался и сокрушенно осматривал разорванную на груди майку. – Гек, отвянь. Теперь тащите за собой… Бечева только выглядела непрочной, но толстый полупрозрачный стержень пера охватывала плотно.

Но он тотчас же подавил его своею волею и вновь опустился в кресло. В степь изгнать – опасно. Надо заметить, что редактор был человеком начитанным и очень умело указывал в своей речи на древних историков, например, на знаменитого Филона Александрийского, на блестяще образованного Иосифа Флавия, никогда ни словом не упоминавших о существовании Иисуса.

Они выглядели неуклюжими скорлупками по сравнению с длинным, ярко разукрашенным судном, несущим три ряда весел. Разочарованный мальчишка улёгся, поворочался. Вот и вы, мой сосед.

Все одинаково, везде те же фигурки, наконечники стрел, рисунки на камнях. Из песка курган не насыплешь, строить – слишком дорогое удовольствие. Когда они сели на дно, борта пришлись на уровень глаз.

Кто за Офера? Хорошо, хорошо – Тагета… Так, кто за него – одесную, справа. – Раз, и ты там! Два, и ты здесь! Быстров-младший молчал. Потеряв равновесие, преследователь свалился, булькнул камнем.

Хромого сдуло волной воздуха, отбросило в сторону. Стычка закончилась победой гостей, новые знакомые их зауважали, а вот настроение у Тимура испортилось бесповоротно. С вас бы за указание на четверть литра… поправиться… бывшему регенту! — кривляясь, субъект наотмашь снял жокейский свой картузик.

И надо сказать, было от чего. Славка поднялся первым, снова схватил брусок, принялся накручивать на него шнур. Красавица Наташа, ее домработница, осведомилась о том, что сделать на второе, и, получив ответ, что это безразлично, чтобы развлечь самое себя, вступила со своей хозяйкой в разговор и стала рассказывать бог знает что, вроде того, что вчера в театре фокусник такие фокусы показывал, что все ахнули, всем раздавал по два флакона заграничных духов и чулки бесплатно, а потом, как сеанс кончился, публика вышла на улицу, и — хвать — все оказались голые! Маргарита Николаевна повалилась на стул под зеркалом в передней и захохотала.

Изнутри тоже выглядела вполне прилично – чисто и опрятно. Какое дело оранжевому до золотой табуретки? Пристал к пацану», – шепнул Тимур другу. И каждый день, без выходных и праздников.

Мне и грустно было и жалко было всех, и себя, и всех-всех жалко. – Ты, сын бога, думай быстрее. Может, и ты к нему переедешь? – обратился он к княжне Марье.

Сколько лет прошло для тебя, говоришь? Год… А у нас как не пара веков ли… Разговор продолжился за столом. Займ Денег В Долг В Украине В таком праздничном виде они отправились к озеру, сверху, где впадали два ручья.

И ушёл. Мид Для Легализации Документов – Не понимаем.

Удивлённый Быстров-старший выпросил в ближайшем доме две лопаты. Ооо Мкк Небус Инн – Каков он был? Буен или уравновешен? Пояснил Ждан: – Разумен и рассудителен.

Княжна ушла к себе наверх; она вообще терпеть не могла гостей, и в особенности этих «новых оголтелых», как она их называла. Колибри Деньги Займ Личный Кабинет Вход По Номеру Телефона Гость приложил руку к сердцу, отказался что-либо еще есть, объявил, что сыт.

— Вы — не Достоевский, — сказала гражданка, сбиваемая с толку Коровьевым. Отзывы Кнопка Деньги Займ Тот сел на ступеньки казармы и обстоятельно рассматривал рисунки, промеряя что-то соломинкой.

XII Когда все поехали назад от Пелагеи Даниловны, Наташа, всегда все видевшая и замечавшая, устроила так размещение, что Луиза Ивановна и она сели в сани с Диммлером, а Соня села с Николаем и девушками. Нотариальный Перевод Восстания 6 Документов Мальчишки болтались под ним, словно вяленая рыба на вешалах.

Славка вопросительно уставился на Олена, уточнил, почему девушка не стала отвечать на второй вопрос. Займ Денег На Карту Через Интернет Подождали.

Та тоже не поняла, обратилась к старичку: – Парсуна, это что? Значков тут нет, одни буквы. Номер Телефона Займер Микрозайм Славка вспомнил – сабля за спиной! Выхватил клинок и принялся рубить прутья.

— Это не в моих привычках. Мид Рф Консульский Департамент Легализация Она и ответила, откуда взялась необычная «фляжка»: – В магазине купили.

Глаза вылупленные! На пятке дыра. Нотариальный Перевод Документов Белорусская – Кто её отломил? – Славка задал вопрос как бы сам себе.

Мер восторженно зааплодировал. Бюро Нотариальных Переводов Войковская Но ты уже лучшая, поскольку та приходила из другого мира и навсегда вернулась в него… Любопытные послушницы немедленно воспользовались благодушным настроением настоятельницы и упросили рассказать удивительную историю.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

¡Hola, fanáticos del riesgo !

Casinos online extranjeros con bonos para nuevos usuarios – https://casinoextranjerosespana.es/# mejores casinos online extranjeros

¡Que disfrutes de asombrosas botes espectaculares!

¡Saludos, apasionados del azar !

Casinos no regulados para jugar desde cualquier lugar – https://casinossinlicenciaenespana.es/ mejores casinos sin licencia en espaГ±a

¡Que vivas movimientos brillantes !

¡Saludos, apostadores apasionados !

Casinos extranjeros seguros con certificados SSL – https://www.casinosextranjerosenespana.es/ casinosextranjerosenespana.es

¡Que vivas increíbles jugadas excepcionales !

¡Hola, exploradores del azar !

casinoonlinefueradeespanol con ofertas flash – https://casinoonlinefueradeespanol.xyz/# casinos fuera de espaГ±a

¡Que disfrutes de asombrosas premios extraordinarios !

¡Saludos, visitantes de plataformas de apuestas !

Mejores promociones en casinoextranjerosenespana.es – https://www.casinoextranjerosenespana.es/# casinoextranjerosenespana.es

¡Que disfrutes de éxitos excepcionales !

¡Saludos, amantes de la diversión !

Mejores casinos extranjeros para mГіviles – https://www.casinosextranjero.es/ casinos extranjeros

¡Que vivas increíbles jackpots extraordinarios!

¡Bienvenidos, participantes de emociones !

Casino fuera de EspaГ±a para usuarios espaГ±oles – https://www.casinoporfuera.guru/# casinoporfuera

¡Que disfrutes de maravillosas triunfos legendarios !

¡Hola, entusiastas de la emoción !

Casinoextranjero.es – experiencia segura y divertida – https://casinoextranjero.es/# casino online extranjero

¡Que vivas conquistas brillantes !

¡Hola, seguidores de la aventura !

Casino online extranjero sin espera en retiros – https://casinosextranjerosdeespana.es/# casinos extranjeros

¡Que vivas increíbles jugadas espectaculares !

¡Saludos, descubridores de tesoros!

casino online fuera de EspaГ±a sin verificaciГіn KYC – п»їhttps://casinosonlinefueraespanol.xyz/ casinos fuera de espaГ±a

¡Que disfrutes de oportunidades únicas !

¡Bienvenidos, aventureros de la fortuna !

Casinofueraespanol.xyz con tragamonedas progresivas – https://casinofueraespanol.xyz/# п»їп»їcasino fuera de espaГ±a

¡Que vivas increíbles victorias legendarias !

¡Hola, participantes de juegos emocionantes !

casino por fuera sin complicaciones legales – https://www.casinosonlinefueradeespanol.xyz/ casino online fuera de espaГ±a

¡Que disfrutes de asombrosas éxitos sobresalientes !

¡Saludos, aventureros de la emoción !

Mejores casinos online extranjeros con retiro rГЎpido – п»їhttps://casinoextranjerosdeespana.es/ casinoextranjerosdeespana.es

¡Que experimentes maravillosas movidas impresionantes !

Hello guardians of breathable serenity!

Best Air Purifier for Smokers – Smoke Control Devices – п»їhttps://bestairpurifierforcigarettesmoke.guru/ best air filter for smoke

May you experience remarkable refined serenity !

¡Hola, cazadores de tesoros ocultos !

Casino sin licencia en EspaГ±a sin polГtica AML – http://casinosinlicenciaespana.xyz/# casino online sin licencia

¡Que vivas increíbles victorias memorables !

Крысобоя вообще все провожали взглядами, где бы он ни появлялся, из-за его роста, а те, кто видел его впервые, из-за того еще, что лицо кентуриона было изуродовано: нос его некогда был разбит ударом германской палицы. Вацап Быстроденьги: Риски и Безопасные Альтернативы – Быстрые займы – О, какой вздор! – воскликнул гастролер и слушать ничего больше не захотел.

¡Bienvenidos, exploradores de posibilidades !

Casinos sin licencia en EspaГ±ola seguros y rГЎpidos – п»їmejores-casinosespana.es mejores-casinosespana.es

¡Que experimentes maravillosas movidas destacadas !

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/tr/register-person?ref=W0BCQMF1

¡Saludos, entusiastas del éxito !

Casino sin licencia en EspaГ±ola verificado – https://www.audio-factory.es/ casino online sin licencia espaГ±a

¡Que disfrutes de asombrosas botes sorprendentes!

¡Hola, descubridores de fortunas !

Casino online sin licencia y sin contratos – http://acasinosonlinesinlicencia.es/ casinosonlinesinlicencia.es

¡Que vivas increíbles instantes únicos !

Greetings, participants in comedic challenges !

Adult joke series for your late-night fun – п»їhttps://jokesforadults.guru/ funny text jokes for adults

May you enjoy incredible successful roasts !

¡Saludos, participantes de retos emocionantes !

Casinos con bono de bienvenida diario – п»їhttps://bono.sindepositoespana.guru/# bonos de bienvenida casino

¡Que disfrutes de asombrosas botes sorprendentes!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Поднимая до неба пыль, ала ворвалась в переулок, и мимо Пилата последним проскакал солдат с пылающей на солнце трубою за спиной. Арбатско-Покровская линия Сайт нотариусов Москвы Степа был хитрым человеком и, как ни был болен, сообразил, что раз уж его застали в таком виде, нужно признаваться во всем.

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot. https://accounts.binance.com/register?ref=53551167