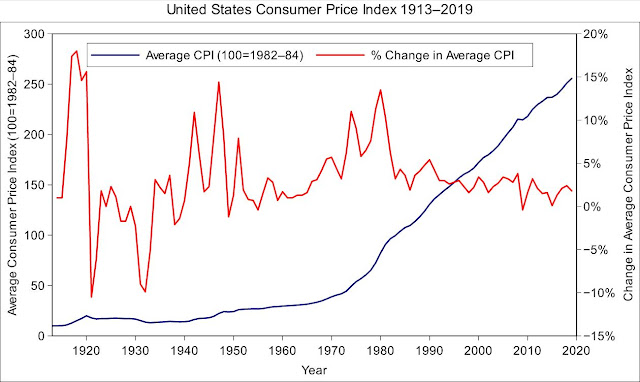

What is Consumer Price Index (CPI)?

The consumer price index is an economic indicator and a measure of

inflation. It is the weighted average increase in the household expense every

month in each fiscal year. The household expense includes a basket of goods and

services such as food and beverages, rental expense, education, entertainment,

transportation, clothes, other essential services such as haircut, etc. CPI is

calculated by aggregating the price change of all the household expenses as compared

to the base year and averaging them.

To be specific, the price change for every item is calculated in the

following way, each item in the basket is assigned a different weight depending

upon many economic factors and later multiplied with the price change of that

particular goods and service. In other words, the CPI index denotes the average

price change in the goods and services over time. For example, if the weighted

average price of consumer goods and services for the year 2008 is $100, while

in 2009 the same goods and services are worth $120, then, in this case, the net

CPI is 20%.

Effect of CPI on Purchasing Power:

The consumer’s purchasing power increases

when the aggregate price level decreases and vice versa. In other words, the value

of the dollar falls in case the price of goods and services increase.

A large rise in the CPI levels in a very short period of time is called a

period of inflation whereas a large drop in the CPI levels is termed as a period

of deflation. If the CPI index is under control then it is believed that

the economy will do good and we can expect good returns from the Stock market.

(To know more about the stock market, refer our most popular article: Basics of Stock Market)

FYI, when the inflation rate is much more than the expected rate, for

example, a 14% increase in inflation indicates a hyperinflation situation. (We

will know much about hyperinflation in our next post, so stay tuned)

Who is responsible to control inflation?

It is the responsibility of the Central Bank (E.g. RBI, in case of India)

and the government to keep inflation levels under control and thus they come up

with different economic policies which also includes creating a limit for CPI

inflation every year, where the goal is to keep the inflation between the said

limits. For example, In India, the increase in the CPI index should be between

2% to 6%. More than 6% indicate that Inflation is more than expected and it

creates a negative impact on the economy. Even inflation of less than 2% gives

a negative impact as it is believed that the companies are not able to increase

the prices of their goods because the consumers are not having sufficient

purchasing power and they are not ready to spend more, hence the prices are

reduced because of low demand.

CPI calculation formula (for single item)

Who calculates CPI?

CPI index is nothing but the household expenses inflation, however, it

is important to monitor this index regularly and hence there are some international

organisations like “Organisation for economic co-operation and development” who

are responsible for reporting the CPI figures (monthly, quarterly or annually)

for many of its member countries. For instance, in the United States, the CPI

figures are calculated by “Bureau of economic analysis” and in India, the CPI

is calculated by “Ministry of statistics and programme and implementation”

Final Words:

CPI is one of the most important and closely watched national economic

indicators. It is an ideal tool for calculating actual inflation figures at a

consumer level and most importantly it is accepted all over the world.

Thanks for reading

If you have any queries, you can drop me a mail at

thefinancemagic@gmail.com or you can drop a comment in the below comment

section and we will get back to you as soon as possible. Till then check out

our other popular articles

- Mutual fund for

Beginners – The Complete Guide - Best Finance Books Ever Written!

- A Complete Guide on the Stock Market

Let’s spread financial literacy together.

Do subscribe to get notifications of the latest articles.

Thanks for reading.

The Finance Magic

You have given essential data for us. about Tax CPA In Santa Barbara It is excellent and good for everyone. Keep posting always. I am very thankful to you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/register?ref=P9L9FQKY

Your article helped me a lot, is there any more related content? Thanks!

I’m really impressed with your writing skills as well as with the format for your blog. Is that this a paid topic or did you modify it your self? Either way stay up the excellent high quality writing, it is uncommon to peer a great blog like this one these days. !

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Here, you can find a great variety of slot machines from top providers.

Users can enjoy classic slots as well as feature-packed games with high-quality visuals and exciting features.

If you’re just starting out or an experienced player, there’s always a slot to match your mood.

play casino

The games are available round the clock and designed for PCs and mobile devices alike.

No download is required, so you can get started without hassle.

Platform layout is easy to use, making it convenient to browse the collection.

Register now, and enjoy the world of online slots!

The site makes it possible to find workers for temporary risky jobs.

Visitors are able to quickly schedule services for specific operations.

All workers are experienced in managing sensitive operations.

hitman for hire

This site provides secure arrangements between employers and contractors.

For those needing a quick solution, this platform is ready to help.

Post your request and find a fit with a skilled worker instantly!

Questa pagina permette l’ingaggio di persone per compiti delicati.

Gli interessati possono ingaggiare candidati qualificati per operazioni isolate.

Le persone disponibili vengono verificati con cura.

assumere un killer

Sul sito è possibile visualizzare profili prima della selezione.

La fiducia resta un nostro impegno.

Esplorate le offerte oggi stesso per trovare il supporto necessario!

На данной странице вы можете получить рабочую копию сайта 1хбет без проблем.

Систематически обновляем доступы, чтобы предоставить стабильную работу к порталу.

Используя зеркало, вы сможете получать весь функционал без перебоев.

1xbet-official.live

Эта страница поможет вам безопасно получить рабочее зеркало 1хбет.

Нам важно, чтобы каждый пользователь смог использовать все возможности.

Следите за актуальной информацией, чтобы всегда быть онлайн с 1 икс бет!

Этот сайт — подтверждённый онлайн-площадка Bottega Венета с доставкой по всей России.

На нашем сайте вы можете купить фирменную продукцию Боттега Венета официально.

Каждый заказ подтверждаются оригинальными документами от компании.

bottega-official.ru

Перевозка осуществляется без задержек в любой регион России.

Наш сайт предлагает выгодные условия покупки и комфортные условия возврата.

Доверьтесь официальном сайте Bottega Veneta, чтобы быть уверенным в качестве!

在这个网站上,您可以雇佣专门从事一次性的高危工作的执行者。

我们集合大量经验丰富的从业人员供您选择。

不管是何种高风险任务,您都可以方便找到合适的人选。

为了钱而下令谋杀

所有作业人员均经过背景调查,保障您的隐私。

任务平台注重安全,让您的任务委托更加安心。

如果您需要更多信息,请随时咨询!

Through this platform, you can discover various CS:GO betting sites.

We have collected a variety of gaming platforms focused on the CS:GO community.

Every website is handpicked to provide fair play.

top csgo gambling sites

Whether you’re a CS:GO enthusiast, you’ll quickly choose a platform that meets your expectations.

Our goal is to guide you to enjoy the top-rated CS:GO wagering platforms.

Explore our list right away and elevate your CS:GO playing experience!

On this platform, you can find a wide selection of online slots from top providers.

Visitors can try out classic slots as well as feature-packed games with vivid animation and bonus rounds.

Even if you’re new or a seasoned gamer, there’s something for everyone.

play aviator

The games are instantly accessible 24/7 and optimized for laptops and mobile devices alike.

All games run in your browser, so you can get started without hassle.

Site navigation is easy to use, making it simple to explore new games.

Register now, and enjoy the excitement of spinning reels!

Оформление страхового полиса для заграничной поездки — это обязательное условие для обеспечения безопасности путешественника.

Страховка включает медицинскую помощь в случае заболевания за границей.

Кроме того, полис может включать оплату на транспортировку.

страховка авто

Определённые государства настаивают на оформление полиса для въезда.

Если нет страховки госпитализация могут обойтись дорого.

Приобретение документа заранее

Questo sito permette il reclutamento di professionisti per attività a rischio.

Gli interessati possono selezionare esperti affidabili per incarichi occasionali.

Gli operatori proposti sono valutati secondo criteri di sicurezza.

ordina omicidio

Sul sito è possibile visualizzare profili prima della selezione.

La professionalità resta la nostra priorità.

Esplorate le offerte oggi stesso per ottenere aiuto specializzato!

В данном ресурсе вы увидите исчерпывающие сведения о программе лояльности: 1win партнерская программа.

Доступны все аспекты работы, критерии вступления и ожидаемые выплаты.

Каждая категория четко изложен, что позволяет легко разобраться в аспектах системы.

Кроме того, есть ответы на частые вопросы и подсказки для новых участников.

Материалы поддерживаются в актуальном состоянии, поэтому вы смело полагаться в актуальности предоставленных данных.

Ресурс послужит подспорьем в понимании партнёрской программы 1Win.

магазин аккаунтов https://birzha-akkauntov-online.ru/

маркетплейс аккаунтов перепродажа аккаунтов

– Ultra-Soft Skin: Simulates the touch and warmth of real human skin with medical-grade TPE material.

– Full-Body Versatility: Designed for intimate explorations — vaginal, anal, oral, and more.

Exclusive AliExpress Offer: Secure your premium companion at a special price – stock is limited.

Order Now on AliExpress

купить аккаунт аккаунт для рекламы

услуги по продаже аккаунтов гарантия при продаже аккаунтов

безопасная сделка аккаунтов https://prodat-akkaunt-online.ru/

аккаунты с балансом https://kupit-akkaunt-top.ru/

купить аккаунт магазин аккаунтов

The site offers you the chance to hire professionals for one-time risky projects.

Clients may securely schedule help for specific requirements.

All listed individuals are experienced in executing intense tasks.

hire a hitman

This site provides safe interactions between users and workers.

For those needing immediate help, this platform is the right choice.

Post your request and connect with a skilled worker today!

La nostra piattaforma permette l’assunzione di persone per incarichi rischiosi.

Chi cerca aiuto possono ingaggiare candidati qualificati per operazioni isolate.

Le persone disponibili vengono scelti secondo criteri di sicurezza.

sonsofanarchy-italia.com

Utilizzando il servizio è possibile consultare disponibilità prima della selezione.

La sicurezza è un nostro impegno.

Esplorate le offerte oggi stesso per trovare il supporto necessario!

Find Accounts for Sale Accounts marketplace

Accounts marketplace Find Accounts for Sale

Social media account marketplace Account trading platform

Buy Pre-made Account Marketplace for Ready-Made Accounts

Searching to connect with experienced contractors willing for one-time dangerous assignments.

Need a freelancer for a perilous assignment? Find vetted individuals on our platform to manage time-sensitive dangerous operations.

hire a killer

This website links clients with trained workers willing to accept high-stakes short-term roles.

Hire pre-screened freelancers to perform perilous tasks securely. Ideal when you need urgent assignments requiring safety-focused skills.

Account Acquisition Accounts for Sale

Secure Account Sales Account Trading Service

Account Market Sell Pre-made Account

Ready-Made Accounts for Sale Marketplace for Ready-Made Accounts

Buy Account Find Accounts for Sale

Account Selling Platform Account market

Account Buying Service Secure Account Purchasing Platform

Our service allows you to connect with workers for short-term dangerous tasks.

You can efficiently request assistance for specialized operations.

All listed individuals are trained in managing sensitive jobs.

assassin for hire

Our platform provides discreet connections between clients and freelancers.

If you require urgent assistance, this platform is ready to help.

Post your request and match with a skilled worker in minutes!

On this platform, you can access a great variety of online slots from top providers.

Players can enjoy traditional machines as well as modern video slots with vivid animation and exciting features.

Whether you’re a beginner or an experienced player, there’s something for everyone.

money casino

The games are instantly accessible anytime and designed for desktop computers and tablets alike.

All games run in your browser, so you can jump into the action right away.

Site navigation is easy to use, making it convenient to browse the collection.

Sign up today, and enjoy the world of online slots!

find accounts for sale buy and sell accounts

buy account account purchase

social media account marketplace account purchase

People think about suicide due to many factors, commonly arising from severe mental anguish.

Feelings of hopelessness can overwhelm someone’s will to live. In many cases, isolation contributes heavily to this choice.

Mental health issues impair decision-making, making it hard for individuals to see alternatives to their pain.

how to kill yourself

Life stressors could lead a person closer to the edge.

Inadequate support systems can make them feel stuck. Understand seeking assistance can save lives.

account purchase accounts market

ready-made accounts for sale buy and sell accounts

accounts marketplace verified accounts for sale

account catalog accounts for sale

purchase ready-made accounts account purchase

secure account purchasing platform accounts for sale

account marketplace guaranteed accounts

ready-made accounts for sale sell accounts

account selling service account store

buy account account acquisition

buy and sell accounts account exchange

account marketplace account marketplace

account exchange service website for buying accounts

accounts marketplace account catalog

您好,这是一个成人网站。

进入前请确认您已年满十八岁,并同意了解本站内容性质。

本网站包含限制级信息,请谨慎浏览。 色情网站。

若您未满18岁,请立即关闭窗口。

我们致力于提供健康安全的网络体验。

buy accounts verified accounts for sale

sell pre-made account account acquisition

accounts marketplace purchase ready-made accounts

account selling service online account store

secure account purchasing platform account exchange

secure account sales accounts for sale

Searching for a person to take on a one-time dangerous assignment?

Our platform specializes in linking customers with freelancers who are willing to tackle critical jobs.

Whether you’re dealing with urgent repairs, hazardous cleanups, or complex installations, you’re at the perfect place.

All listed professional is pre-screened and qualified to guarantee your safety.

rent a hitman

This service offer transparent pricing, detailed profiles, and secure payment methods.

No matter how challenging the scenario, our network has the skills to get it done.

Start your search today and locate the perfect candidate for your needs.

You can find here valuable information about techniques for turning into a cyber specialist.

Information is provided in a straightforward and coherent manner.

You will learn several procedures for gaining access.

Furthermore, there are practical examples that reveal how to perform these capabilities.

how to become a hacker

Whole material is persistently upgraded to keep up with the current breakthroughs in network protection.

Notable priority is given to functional usage of the developed competencies.

Bear in mind that any undertaking should be used legally and through ethical means only.

secure account sales buy accounts

guaranteed accounts accounts for sale

profitable account sales account buying service

account market https://top-social-accounts.org/

The platform is available useful promo codes for One X Bet.

These promocodes make it possible to receive extra benefits when betting on the service.

All existing bonus options are constantly refreshed to maintain their usability.

Through these bonuses it is possible to improve your chances on 1xBet.

https://technohadayat.com/pages/effektivnaya_pomoschy_v_sezon_prostud_dlya_vsey_semyi.html

Furthermore, detailed instructions on how to implement bonus codes are available for ease of use.

Be aware that selected deals may have specific terms, so review terms before using.

Hello to our platform, where you can find special materials created specifically for adults.

All the resources available here is appropriate for individuals who are over 18.

Ensure that you are eligible before continuing.

suck

Enjoy a special selection of age-restricted content, and dive in today!

On this platform you can discover limited bonus codes for 1xBet.

The set of profitable chances is constantly renewed to assure that you always have means to utilize the up-to-date arrangements.

Through these bonus codes, you can economize considerably on your bets and improve your probability of accomplishment.

All promo codes are meticulously examined for legitimacy and effectiveness before getting posted.

https://aadesignoffice.com/pages/kak_vyglyadit_sovremennyy_kuhonnyy_processor_ne_prosto_blender.html

Plus, we provide comprehensive guidelines on how to put into action each enticing proposal to optimize your rewards.

Keep in mind that some offers may have special provisions or set deadlines, so it’s paramount to inspect diligently all the particulars before utilizing them.

sell account https://accounts-offer.org/

sell accounts https://accounts-marketplace.xyz

account selling platform https://buy-best-accounts.org

account market https://social-accounts-marketplaces.live

The site offers many types of prescription drugs for home delivery.

Anyone can conveniently order needed prescriptions from anywhere.

Our catalog includes everyday solutions and custom orders.

Each item is acquired via trusted providers.

how long does it take for cialis to work

We prioritize user protection, with encrypted transactions and timely service.

Whether you’re looking for daily supplements, you’ll find affordable choices here.

Begin shopping today and enjoy stress-free online pharmacy service.

account acquisition https://accounts-marketplace.live

profitable account sales https://social-accounts-marketplace.xyz

account store accounts marketplace

1XBet represents a leading sports betting platform.

Offering an extensive selection of events, 1xBet serves a vast audience around the world.

The 1XBet app is designed for both Android devices as well as iPhone players.

https://ville-barentin.fr/wp-content/pgs/preimuschestva_ispolyzovaniya_mansard.html

You can install the application via the platform’s page or Google’s store for Android.

iPhone customers, this software can be downloaded through the App Store with ease.

account selling service buy-accounts-shop.pro

marketplace for ready-made accounts https://accounts-marketplace.art

accounts market https://social-accounts-marketplace.live

account marketplace https://buy-accounts.live

secure account sales https://accounts-marketplace.online

buy accounts account market

На этом сайте вы можете найти актуальные промокоды от Мелбет.

Примените коды во время создания аккаунта на платформе и получите максимальную награду на первый депозит.

Плюс ко всему, здесь представлены коды для текущих акций и постоянных игроков.

мелбет промокод бонус на депозит

Обновляйте информацию на странице бонусов, чтобы не упустить особые условия от Melbet.

Все промокоды обновляется на валидность, что гарантирует надежность в процессе применения.

купить аккаунт akkaunty-na-prodazhu.pro

продажа аккаунтов https://rynok-akkauntov.top/

продать аккаунт kupit-akkaunt.xyz

This online service features a large selection of medications for home delivery.

You can conveniently access health products with just a few clicks.

Our inventory includes popular treatments and custom orders.

All products is provided by trusted providers.

kamagra oral jelly

We ensure user protection, with data protection and on-time dispatch.

Whether you’re managing a chronic condition, you’ll find affordable choices here.

Explore our selection today and experience stress-free support.

One X Bet Bonus Code – Vip Bonus as much as 130 Euros

Use the 1xBet promotional code: 1xbro200 during sign-up on the app to avail special perks given by 1XBet to receive €130 as much as 100%, for placing bets plus a 1950 Euros featuring one hundred fifty free spins. Launch the app followed by proceeding by completing the registration steps.

The 1xBet promotional code: 1XBRO200 provides an amazing starter bonus for first-time users — full one hundred percent as much as €130 upon registration. Promo codes are the key for accessing rewards, and 1XBet’s promotional codes are no exception. When applying the code, bettors may benefit of several promotions at different stages within their betting activity. Although you aren’t entitled to the starter reward, 1XBet India makes sure its regular customers are rewarded through regular bonuses. Visit the Offers page on the site regularly to keep informed on the latest offers meant for current users.

best 1xbet promo code

What One X Bet bonus code is now valid today?

The promo code relevant to 1xBet is 1XBRO200, which allows first-time users registering with the gambling provider to gain an offer worth €130. In order to unlock special rewards for casino and bet placement, kindly enter this special code for 1XBET while filling out the form. In order to benefit from this deal, potential customers should enter the promotional code 1xbet during the registration procedure so they can obtain a 100% bonus for their first payment.

On this site, discover live video chats.

Whether you’re looking for casual conversations or professional networking, you’ll find a solution tailored to you.

The video chat feature developed to connect people globally.

Featuring HD streams plus excellent acoustics, any discussion is immersive.

Participate in public rooms initiate one-on-one conversations, according to what suits you best.

https://rt.sexy-888.com/couples

All you need is a stable internet connection plus any compatible tool begin chatting.

купить аккаунт https://akkaunt-magazin.online/

маркетплейс аккаунтов https://akkaunty-market.live/

маркетплейс аккаунтов соцсетей https://kupit-akkaunty-market.xyz

купить аккаунт akkaunty-optom.live

купить аккаунт online-akkaunty-magazin.xyz

маркетплейс аккаунтов соцсетей https://akkaunty-dlya-prodazhi.pro

маркетплейс аккаунтов https://kupit-akkaunt.online/

Within this platform, you can discover a variety internet-based casino sites.

Interested in well-known titles new slot machines, there’s something for every player.

The listed platforms are verified for trustworthiness, enabling gamers to bet securely.

1xbet

Moreover, this resource provides special rewards and deals to welcome beginners including long-term users.

Thanks to user-friendly browsing, finding your favorite casino is quick and effortless, saving you time.

Keep informed on recent updates through regular check-ins, since new casinos come on board often.

На этом сайте вы можете найти живые видеочаты.

Вы хотите дружеское общение переговоры, вы найдете решения для каждого.

Этот инструмент создана для взаимодействия глобально.

зрелые эро чат

Благодаря HD-качеству плюс отличному аудио, вся беседа остается живым.

Вы можете присоединиться к публичным комнатам общаться один на один, в зависимости от ваших предпочтений.

Все, что требуется — стабильное интернет-соединение и любое поддерживаемое устройство, чтобы начать.

On this platform, you can discover a great variety of slot machines from top providers.

Visitors can experience traditional machines as well as feature-packed games with stunning graphics and bonus rounds.

Whether you’re a beginner or a casino enthusiast, there’s something for everyone.

casino slots

Each title are instantly accessible anytime and optimized for desktop computers and tablets alike.

No download is required, so you can jump into the action right away.

Site navigation is intuitive, making it simple to find your favorite slot.

Register now, and discover the thrill of casino games!

On this platform, you can access a wide selection of slot machines from famous studios.

Users can enjoy retro-style games as well as modern video slots with vivid animation and bonus rounds.

Whether you’re a beginner or a seasoned gamer, there’s something for everyone.

casino games

Each title are instantly accessible 24/7 and compatible with PCs and smartphones alike.

All games run in your browser, so you can start playing instantly.

Platform layout is user-friendly, making it quick to explore new games.

Sign up today, and dive into the excitement of spinning reels!

This website, you can access a great variety of casino slots from top providers.

Users can experience traditional machines as well as feature-packed games with stunning graphics and bonus rounds.

Whether you’re a beginner or a seasoned gamer, there’s always a slot to match your mood.

casino

Each title are ready to play round the clock and designed for laptops and mobile devices alike.

No download is required, so you can jump into the action right away.

The interface is user-friendly, making it simple to browse the collection.

Register now, and enjoy the world of online slots!

facebook ad account buy https://buy-adsaccounts.work

buying facebook accounts https://buy-ad-accounts.click/

buy facebook account https://buy-ad-account.top

buy facebook ad account buy fb ad account

buy aged facebook ads accounts buying facebook accounts

facebook accounts for sale https://buy-ads-account.work

buy facebook advertising accounts buy facebook accounts for advertising

facebook ads accounts https://buy-ad-account.click

В этой публикации мы предлагаем подробные объяснения по актуальным вопросам, чтобы помочь читателям глубже понять их. Четкость и структурированность материала сделают его удобным для усвоения и применения в повседневной жизни.

Подробнее тут – https://medalkoblog.ru/

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

cheap facebook advertising account buy facebook ad account

sell google ads account https://buy-ads-account.top

buy google adwords accounts google ads agency account buy

cheap facebook advertising account https://buy-accounts.click

buy google ads threshold accounts https://ads-account-for-sale.top/

buy google ads account buy google ads threshold account

This flight-themed slot blends adventure with high stakes.

Jump into the cockpit and spin through aerial challenges for massive payouts.

With its classic-inspired graphics, the game captures the spirit of pioneering pilots.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – cash out before it flies away to grab your rewards.

Featuring smooth gameplay and immersive sound effects, it’s a favorite for slot enthusiasts.

Whether you’re chasing wins, Aviator delivers uninterrupted excitement with every round.

google ads account seller https://buy-ads-invoice-account.top

adwords account for sale https://buy-account-ads.work

buy aged google ads accounts https://buy-ads-agency-account.top/

buy account google ads https://sell-ads-account.click

本网站 提供 多样的 成人资源,满足 各类人群 的 需求。

无论您喜欢 哪一类 的 影片,这里都 一应俱全。

所有 材料 都经过 精心筛选,确保 高清晰 的 浏览感受。

视频 18+

我们支持 各种终端 访问,包括 手机,随时随地 畅享内容。

加入我们,探索 无限精彩 的 两性空间。

facebook bm account buy buy verified business manager facebook

buy google ads agency account https://ads-agency-account-buy.click

The Aviator Game blends exploration with exciting rewards.

Jump into the cockpit and play through cloudy adventures for huge multipliers.

With its retro-inspired graphics, the game reflects the spirit of pioneering pilots.

download aviator game

Watch as the plane takes off – cash out before it vanishes to grab your earnings.

Featuring instant gameplay and realistic sound effects, it’s a favorite for gambling fans.

Whether you’re testing luck, Aviator delivers endless action with every flight.

本网站 提供 多样的 成人材料,满足 各类人群 的 需求。

无论您喜欢 哪种类型 的 内容,这里都 应有尽有。

所有 材料 都经过 专业整理,确保 高品质 的 浏览感受。

偷窥

我们支持 不同平台 访问,包括 手机,随时随地 自由浏览。

加入我们,探索 激情时刻 的 私密乐趣。

google ads account buy https://buy-verified-ads-account.work

business manager for sale verified facebook business manager for sale

facebook verified business manager for sale https://buy-business-manager-acc.org

buy verified facebook business manager account buy-verified-business-manager-account.org

buy fb business manager https://buy-verified-business-manager.org

buy facebook bm account business-manager-for-sale.org

buy verified business manager https://buy-business-manager-verified.org

buy verified bm buy-bm.org

On this site, find a variety of online casinos.

Whether you’re looking for traditional options latest releases, there’s a choice for every player.

Every casino included fully reviewed for trustworthiness, so you can play securely.

1xbet

Moreover, the site provides special rewards along with offers for new players including long-term users.

Thanks to user-friendly browsing, locating a preferred platform is quick and effortless, enhancing your experience.

Be in the know about the latest additions by visiting frequently, as fresh options come on board often.

verified business manager for sale verified-business-manager-for-sale.org

Here, explore an extensive selection of online casinos.

Searching for traditional options new slot machines, there’s a choice for any taste.

Every casino included are verified for trustworthiness, so you can play with confidence.

gambling

Additionally, the site provides special rewards along with offers targeted at first-timers including long-term users.

Due to simple access, locating a preferred platform takes just moments, enhancing your experience.

Stay updated about the latest additions through regular check-ins, since new casinos come on board often.

buy verified business manager buy facebook verified business account

buy tiktok business account https://buy-tiktok-ads-account.org

tiktok ads account for sale https://tiktok-ads-account-buy.org

Here, find a variety internet-based casino sites.

Searching for traditional options new slot machines, there’s a choice for every player.

Every casino included fully reviewed for trustworthiness, so you can play securely.

1xbet

Additionally, this resource unique promotions along with offers targeted at first-timers as well as regulars.

Due to simple access, finding your favorite casino happens in no time, saving you time.

Keep informed about the latest additions through regular check-ins, since new casinos are added regularly.

tiktok ads agency account https://tiktok-ads-account-for-sale.org

buy tiktok ads accounts https://tiktok-agency-account-for-sale.org

buy tiktok ads https://buy-tiktok-ad-account.org

buy tiktok ads tiktok ads agency account

buy tiktok ads account https://buy-tiktok-business-account.org

buy tiktok ads accounts https://buy-tiktok-ads.org

tiktok ads account buy https://tiktok-ads-agency-account.org

Здесь вы найдете фото и видео для взрослых.

Контент подходит для зрелых пользователей.

У нас собраны видео и изображения на любой вкус.

Платформа предлагает лучшие материалы в сети.

порно чат пары онлайн

Вход разрешен только после проверки.

Наслаждайтесь безопасным просмотром.

http://delmeherriman.com/ – Learn about England’s basketball captain Delme Herriman

http://www.delmeherriman.com – Where sports inspiration begins

delmeherriman.com – Home of Mr Versatility basketball biography

http://www.delmeherriman.com – Official site about NCAA and European basketball career

http://delmeherriman.com/ – England basketball captain’s website

https://www.delmeherriman.com/ – The ultimate basketball memoir

English basketball star Career Highlights of Delme Herriman

delmeherriman.com – Home of Mr Versatility basketball biography

https://delmeherriman.com/ – England’s basketball captain unveiled

https://delmeherriman.com – Breaking barriers in basketball

http://delmeherriman.com/ – England basketball captain’s website

Свадебные и вечерние платья 2025 года вдохновляют дизайнеров.

Популярны пышные модели до колен из полупрозрачных тканей.

Детали из люрекса придают образу роскоши.

Греческий стиль с драпировкой возвращаются в моду.

Разрезы на юбках создают баланс между строгостью и игрой.

Ищите вдохновение в новых коллекциях — детали и фактуры оставят в памяти гостей!

https://forum.mladipodjetnik.si/mp/viewtopic.php?f=33&t=12369

В этом месте доступны взрослый контент.

Контент подходит для взрослой аудитории.

У нас собраны видео и изображения на любой вкус.

Платформа предлагает HD-видео.

webcam онлайн порно

Вход разрешен только для взрослых.

Наслаждайтесь простым поиском.

У нас вы можете найти вспомогательные материалы для абитуриентов.

Предоставляем материалы по всем основным предметам с учетом современных требований.

Готовьтесь к ЕГЭ и ОГЭ с помощью тренажеров.

https://nv.kz/last-news/2022/06/05/gdz-po-geometrii/

Образцы задач помогут разобраться с темой.

Регистрация не требуется для удобства обучения.

Интегрируйте в обучение и успешно сдавайте экзамены.

бесплатная доставка цветов доставка цветов на дом спб

заказ цвет с доставкой заказ цветов с доставкой

Трендовые фасоны сезона этого сезона отличаются разнообразием.

В тренде стразы и пайетки из полупрозрачных тканей.

Детали из люрекса придают образу роскоши.

Греческий стиль с драпировкой возвращаются в моду.

Минималистичные силуэты создают баланс между строгостью и игрой.

Ищите вдохновение в новых коллекциях — стиль и качество оставят в памяти гостей!

http://foro.clubdellector.edhasa.es/viewtopic.php?f=6&t=1156672

Свежие актуальные Новости бокса со всего мира. Результаты матчей, интервью, аналитика, расписание игр и обзоры соревнований. Будьте в курсе главных событий каждый день!

Микрозаймы онлайн https://kskredit.ru на карту — быстрое оформление, без справок и поручителей. Получите деньги за 5 минут, круглосуточно и без отказа. Доступны займы с любой кредитной историей.

Хочешь больше денег https://mfokapital.ru Изучай инвестиции, учись зарабатывать, управляй финансами, торгуй на Форекс и используй магию денег. Рабочие схемы, ритуалы, лайфхаки и инструкции — путь к финансовой независимости начинается здесь!

Быстрые микрозаймы https://clover-finance.ru без отказа — деньги онлайн за 5 минут. Минимум документов, максимум удобства. Получите займ с любой кредитной историей.

Сделай сам как сделать бюджетный ремонт Ремонт квартиры и дома своими руками: стены, пол, потолок, сантехника, электрика и отделка. Всё, что нужно — в одном месте: от выбора материалов до финального штриха. Экономьте с умом!

Модные образы для торжеств нынешнего года задают новые стандарты.

В тренде стразы и пайетки из полупрозрачных тканей.

Детали из люрекса делают платье запоминающимся.

Асимметричные силуэты определяют современные тренды.

Особый акцент на открытые плечи создают баланс между строгостью и игрой.

Ищите вдохновение в новых коллекциях — стиль и качество оставят в памяти гостей!

https://www.fm-haxball.co.uk/community/viewtopic.php?f=2&t=246664

КПК «Доверие» https://bankingsmp.ru надежный кредитно-потребительский кооператив. Выгодные сбережения и доступные займы для пайщиков. Прозрачные условия, высокая доходность, финансовая стабильность и юридическая безопасность.

Ваш финансовый гид https://kreditandbanks.ru — подбираем лучшие предложения по кредитам, займам и банковским продуктам. Рейтинг МФО, советы по улучшению КИ, юридическая информация и онлайн-сервисы.

Займы под залог https://srochnyye-zaymy.ru недвижимости — быстрые деньги на любые цели. Оформление от 1 дня, без справок и поручителей. Одобрение до 90%, выгодные условия, честные проценты. Квартира или дом остаются в вашей собственности.

У нас вы можете найти учебные пособия для абитуриентов.

Курсы по ключевым дисциплинам включая естественные науки.

Успешно сдайте тесты благодаря интерактивным заданиям.

https://prykoly.ru/domashnee-zadanie-po-himii-v-8-klasse/

Образцы задач упростят процесс обучения.

Регистрация не требуется для комфортного использования.

Применяйте на уроках и успешно сдавайте экзамены.

balloons arrangements dubai balloons and flowers dubai

engineering resumes examples resume electrical engineer

Модные образы для торжеств этого сезона вдохновляют дизайнеров.

Популярны пышные модели до колен из полупрозрачных тканей.

Металлические оттенки придают образу роскоши.

Греческий стиль с драпировкой становятся хитами сезона.

Разрезы на юбках подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — стиль и качество оставят в памяти гостей!

https://naphopibun.go.th/forum/suggestion-box/931050-u-lini-sv-d-bni-pl-ija-e-g-g-d-s-v-i-p-vib-ru

Услуги массажа Ивантеевка — здоровье, отдых и красота. Лечебный, баночный, лимфодренажный, расслабляющий и косметический массаж. Сертифицированнй мастер, удобное расположение, результат с первого раза.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

вывод из запоя круглосуточно тула

vivod-iz-zapoya-tula003.ru

вывод из запоя круглосуточно

вывод из запоя

vivod-iz-zapoya-vladimir001.ru

экстренный вывод из запоя владимир

вывод из запоя круглосуточно

vivod-iz-zapoya-vladimir002.ru

вывод из запоя владимир

лечение запоя

vivod-iz-zapoya-vladimir003.ru

лечение запоя владимир

вывод из запоя череповец

vivod-iz-zapoya-cherepovec001.ru

вывод из запоя цена

вывод из запоя круглосуточно

vivod-iz-zapoya-cherepovec002.ru

вывод из запоя череповец

вывод из запоя

vivod-iz-zapoya-cherepovec003.ru

вывод из запоя круглосуточно череповец

лечение запоя

vivod-iz-zapoya-kaluga001.ru

вывод из запоя калуга

лечение запоя

vivod-iz-zapoya-kaluga002.ru

лечение запоя

The Audemars Piguet Royal Oak 16202ST features a elegant stainless steel 39mm case with an ultra-thin profile of just 8.1mm thickness, housing the advanced Calibre 7121 movement. Its striking “Bleu nuit nuage 50” dial showcases a signature Petite Tapisserie pattern, fading from a radiant center to dark periphery for a dynamic aesthetic. The octagonal bezel with hexagonal screws pays homage to the original 1972 design, while the glareproofed sapphire crystal ensures optimal legibility.

https://graph.org/Audemars-Piguet-Royal-Oak-16202st-The-Stainless-Steel-Revolution-06-02

Water-resistant to 5 ATM, this “Jumbo” model balances sporty durability with luxurious refinement, paired with a stainless steel bracelet and reliable folding buckle. A modern tribute to horological heritage, the 16202ST embodies Audemars Piguet’s innovation through its meticulous mechanics and evergreen Royal Oak DNA.

вывод из запоя цена

vivod-iz-zapoya-kaluga003.ru

вывод из запоя круглосуточно

вывод из запоя круглосуточно смоленск

vivod-iz-zapoya-smolensk001.ru

лечение запоя

лечение запоя

vivod-iz-zapoya-smolensk002.ru

вывод из запоя круглосуточно

вывод из запоя цена

vivod-iz-zapoya-smolensk003.ru

вывод из запоя цена

вывод из запоя цена

vivod-iz-zapoya-tula001.ru

вывод из запоя круглосуточно тула

Всё о городе городской портал города Ханты-Мансийск: свежие новости, события, справочник, расписания, культура, спорт, вакансии и объявления на одном городском портале.

вывод из запоя цена

vivod-iz-zapoya-tula002.ru

вывод из запоя цена

вывод из запоя тула

vivod-iz-zapoya-tula003.ru

вывод из запоя

вывод из запоя круглосуточно

vivod-iz-zapoya-vladimir001.ru

вывод из запоя

вывод из запоя круглосуточно владимир

vivod-iz-zapoya-vladimir002.ru

экстренный вывод из запоя

вывод из запоя круглосуточно

vivod-iz-zapoya-vladimir003.ru

вывод из запоя

лечение запоя

vivod-iz-zapoya-cherepovec001.ru

вывод из запоя круглосуточно череповец

Здесь можно получить мессенджер-бот “Глаз Бога”, который проверить сведения о человеке из открытых источников.

Бот функционирует по номеру телефона, обрабатывая актуальные базы онлайн. С его помощью осуществляется пять пробивов и полный отчет по имени.

Инструмент обновлен на 2025 год и поддерживает аудио-материалы. Глаз Бога сможет найти профили в соцсетях и отобразит сведения в режиме реального времени.

бот Глаз Бога glazboga.net

Такой сервис — помощник для проверки людей онлайн.

Здесь вы можете найти боту “Глаз Бога” , который позволяет собрать всю информацию о любом человеке из публичных данных.

Уникальный бот осуществляет проверку ФИО и показывает информацию из онлайн-платформ.

С его помощью можно узнать контакты через официальный сервис , используя автомобильный номер в качестве поискового запроса .

пробить авто по номеру

Технология “Глаз Бога” автоматически обрабатывает информацию из проверенных ресурсов, формируя подробный отчет .

Пользователи бота получают 5 бесплатных проверок для проверки эффективности.

Решение постоянно развивается, сохраняя актуальность данных в соответствии с требованиями времени .

На данном сайте вы найдете сервис “Глаз Бога”, позволяющий проверить всю информацию по человеку через открытые базы.

Инструмент функционирует по ФИО, обрабатывая доступные данные в сети. Через бота можно получить пять пробивов и детальный анализ по имени.

Инструмент проверен на август 2024 и охватывает фото и видео. Бот гарантирует проверить личность по госреестрам и отобразит результаты в режиме реального времени.

Глаз Бога

Такой бот — выбор при поиске граждан удаленно.

Мир полон тайн https://phenoma.ru читайте статьи о малоизученных феноменах, которые ставят науку в тупик. Аномальные явления, редкие болезни, загадки космоса и сознания. Доступно, интересно, с научным подходом.

resume aerospace engineer resume google engineer

Читайте о необычном http://phenoma.ru научно-популярные статьи о феноменах, которые до сих пор не имеют однозначных объяснений. Психология, физика, биология, космос — самые интересные загадки в одном разделе.

¿Necesitas promocódigos exclusivos de 1xBet? En nuestra plataforma podrás obtener recompensas especiales para apostar .

La clave 1x_12121 te da acceso a 6500 RUB durante el registro .

Para completar, utiliza 1XRUN200 y disfruta una oferta exclusiva de €1500 + 150 giros gratis.

https://rylankzjs14691.blogsvirals.com/34454307/descubre-cómo-usar-el-código-promocional-1xbet-para-apostar-free-of-charge-en-argentina-méxico-chile-y-más

No te pierdas las ofertas diarias para acumular ventajas exclusivas.

Todos los códigos están actualizados para hoy .

No esperes y multiplica tus apuestas con esta plataforma confiable!

бесплатные акки стим t.me/s/Burger_Game

resume software engineer ats resume electronics engineer

общие аккаунты steam https://t.me/Burger_Game/

На данном сайте вы можете отыскать боту “Глаз Бога” , который способен проанализировать всю информацию о любом человеке из открытых источников .

Этот мощный инструмент осуществляет поиск по номеру телефона и показывает информацию из соцсетей .

С его помощью можно проверить личность через специализированную платформу, используя имя и фамилию в качестве поискового запроса .

пробив с фото

Система “Глаз Бога” автоматически анализирует информацию из проверенных ресурсов, формируя подробный отчет .

Подписчики бота получают пробный доступ для ознакомления с функционалом .

Сервис постоянно совершенствуется , сохраняя высокую точность в соответствии с стандартами безопасности .

Научно-популярный сайт https://phenoma.ru — малоизвестные факты, редкие феномены, тайны природы и сознания. Гипотезы, наблюдения и исследования — всё, что будоражит воображение и вдохновляет на поиски ответов.

На данном сайте доступен сервис “Глаз Бога”, позволяющий найти всю информацию по человеку по публичным данным.

Инструмент активно ищет по номеру телефона, анализируя доступные данные онлайн. Через бота осуществляется бесплатный поиск и детальный анализ по фото.

Сервис актуален согласно последним данным и поддерживает аудио-материалы. Сервис гарантирует проверить личность по госреестрам и отобразит сведения мгновенно.

https://glazboga.net/

Данный бот — идеальное решение в анализе людей удаленно.

Looking for latest 1xBet promo codes? Our platform offers verified bonus codes like GIFT25 for new users in 2025. Claim up to 32,500 RUB as a welcome bonus.

Use official promo codes during registration to maximize your rewards. Benefit from no-deposit bonuses and special promotions tailored for casino games.

Find daily updated codes for global users with fast withdrawals.

All voucher is checked for validity.

Grab limited-time offers like 1x_12121 to double your funds.

Active for new accounts only.

https://gangmaker.org/members/1xbet245/activity/1038441/Keep updated with 1xBet’s best promotions – apply codes like 1XRUN200 at checkout.

Experience smooth rewards with instant activation.

На данном сайте вы можете получить доступ к боту “Глаз Бога” , который позволяет собрать всю информацию о любом человеке из открытых источников .

Этот мощный инструмент осуществляет анализ фото и предоставляет детали из государственных реестров .

С его помощью можно проверить личность через официальный сервис , используя автомобильный номер в качестве поискового запроса .

пробить телефон

Технология “Глаз Бога” автоматически обрабатывает информацию из множества источников , формируя исчерпывающий результат.

Пользователи бота получают ограниченное тестирование для ознакомления с функционалом .

Сервис постоянно обновляется , сохраняя скорость обработки в соответствии с требованиями времени .

Здесь можно получить мессенджер-бот “Глаз Бога”, который собрать всю информацию по человеку из открытых источников.

Сервис функционирует по ФИО, обрабатывая актуальные базы в сети. Через бота доступны пять пробивов и полный отчет по фото.

Платформа обновлен на 2025 год и включает фото и видео. Глаз Бога сможет найти профили в открытых базах и покажет результаты за секунды.

https://glazboga.net/

Данный бот — выбор при поиске людей онлайн.

Сертификация и лицензии — обязательное условие ведения бизнеса в России, гарантирующий защиту от непрофессионалов.

Обязательная сертификация требуется для подтверждения соответствия стандартам.

Для торговли, логистики, финансов необходимо специальных разрешений.

https://ok.ru/group/70000034956977/topic/158859980028081

Игнорирование требований ведут к приостановке деятельности.

Дополнительные лицензии помогает повысить доверие бизнеса.

Соблюдение норм — залог успешного развития компании.

В этом ресурсе вы можете найти боту “Глаз Бога” , который может собрать всю информацию о любом человеке из общедоступных баз .

Уникальный бот осуществляет анализ фото и показывает информацию из соцсетей .

С его помощью можно проверить личность через специализированную платформу, используя имя и фамилию в качестве начальных данных .

сервис пробива

Система “Глаз Бога” автоматически анализирует информацию из открытых баз , формируя исчерпывающий результат.

Подписчики бота получают ограниченное тестирование для проверки эффективности.

Сервис постоянно обновляется , сохраняя актуальность данных в соответствии с стандартами безопасности .

Актуальные новости https://komandor-povolje.ru — политика, экономика, общество, культура и события стран постсоветского пространства, Европы и Азии. Объективно, оперативно и без лишнего — вся Евразия в одном месте.

¿Necesitas promocódigos recientes de 1xBet? Aquí descubrirás bonificaciones únicas para tus jugadas.

La clave 1x_12121 ofrece a 6500 RUB al registrarte .

Para completar, canjea 1XRUN200 y disfruta un bono máximo de 32500 rublos .

https://pastebin.com/u/codigo1xbet2

Mantente atento las ofertas diarias para ganar más beneficios .

Las ofertas disponibles están actualizados para 2025 .

No esperes y maximiza tus ganancias con 1xBet !

Юрист Онлайн https://juristonline.com квалифицированная юридическая помощь и консультации 24/7. Решение правовых вопросов любой сложности: семейные, жилищные, трудовые, гражданские дела. Бесплатная первичная консультация.

Мастера работают russiahelp.com ежедневно без выходных.

Дом из контейнера https://russiahelp.com под ключ — мобильное, экологичное и бюджетное жильё. Индивидуальные проекты, внутренняя отделка, электрика, сантехника и монтаж

Загадки Вселенной https://phenoma.ru паранормальные явления, нестандартные гипотезы и научные парадоксы — всё это на Phenoma.ru

Сайт знакомств https://rutiti.ru для серьёзных отношений, дружбы и общения. Реальные анкеты, удобный поиск, быстрый старт. Встречайте новых людей, находите свою любовь и начинайте общение уже сегодня.

PC application https://authenticatorsteamdesktop.com replacing the mobile Steam Guard. Confirm logins, trades, and transactions in Steam directly from your computer. Support for multiple accounts, security, and backup.

Steam Guard for PC — https://steamdesktopauthenticator.net. Ideal for those who trade, play and do not want to depend on a smartphone. Two-factor protection and convenient security management on Windows.

No more phone needed! https://sdasteam.com lets you use Steam Guard right on your computer. Quickly confirm transactions, access 2FA codes, and conveniently manage security.

Агентство недвижимости https://metropolis-estate.ru покупка, продажа и аренда квартир, домов, коммерческих объектов. Полное сопровождение сделок, юридическая безопасность, помощь в оформлении ипотеки.

Квартиры посуточно https://kvartiry-posutochno19.ru в Абакане — от эконом до комфорт-класса. Уютное жильё в центре и районах города. Чистота, удобства, всё для комфортного проживания.

Прямо здесь вы найдете мессенджер-бот “Глаз Бога”, позволяющий собрать сведения о человеке через открытые базы.

Инструмент работает по номеру телефона, используя публичные материалы в сети. Через бота можно получить бесплатный поиск и глубокий сбор по фото.

Сервис обновлен согласно последним данным и поддерживает мультимедийные данные. Глаз Бога сможет узнать данные в открытых базах и отобразит сведения в режиме реального времени.

https://glazboga.net/

Это инструмент — идеальное решение для проверки граждан онлайн.

Looking for special 1xBet discount vouchers? This platform is your go-to resource to unlock rewarding bonuses for betting .

For both beginners or an experienced player, the available promotions ensures exclusive advantages during registration .

Keep an eye on daily deals to multiply your betting experience .

https://webnowmedia.com/story5083304/1xbet-promo-code-welcome-bonus-up-to-130

Available vouchers are tested for validity to guarantee reliability this month .

Act now of exclusive perks to revolutionize your odds of winning with 1xBet.

СРО УН «КИТ» https://sro-kit.ru саморегулируемая организация для строителей, проектировщиков и изыскателей. Оформление допуска СРО, вступление под ключ, юридическое сопровождение, помощь в подготовке документов.

Ремонт квартир https://berlin-remont.ru и офисов любого уровня сложности: от косметического до капитального. Современные материалы, опытные мастера, прозрачные сметы. Чисто, быстро, по разумной цене.

Ремонт квартир https://remont-kvartir-novo.ru под ключ в новостройках — от черновой отделки до полной готовности. Дизайн, материалы, инженерия, меблировка.

Здесь можно получить мессенджер-бот “Глаз Бога”, что найти данные по человеку по публичным данным.

Инструмент работает по ФИО, анализируя актуальные базы в сети. Благодаря ему осуществляется бесплатный поиск и глубокий сбор по имени.

Платформа проверен на 2025 год и включает мультимедийные данные. Сервис сможет найти профили в соцсетях и покажет результаты мгновенно.

https://glazboga.net/

Данный сервис — идеальное решение для проверки граждан удаленно.

Ремонт квартир https://remont-otdelka-mo.ru любой сложности — от косметического до капитального. Современные материалы, опытные мастера, строгие сроки. Работаем по договору с гарантиями.

Webseite cvzen.de ist Ihr Partner fur professionelle Karriereunterstutzung – mit ma?geschneiderten Lebenslaufen, ATS-Optimierung, LinkedIn-Profilen, Anschreiben, KI-Headshots, Interviewvorbereitung und mehr. Starten Sie Ihre Karriere neu – gezielt, individuell und erfolgreich.

sitio web tavoq.es es tu aliado en el crecimiento profesional. Ofrecemos CVs personalizados, optimizacion ATS, cartas de presentacion, perfiles de LinkedIn, fotos profesionales con IA, preparacion para entrevistas y mas. Impulsa tu carrera con soluciones adaptadas a ti.

На данном сайте вы можете получить доступ к боту “Глаз Бога” , который позволяет получить всю информацию о любом человеке из общедоступных баз .

Данный сервис осуществляет проверку ФИО и показывает информацию из онлайн-платформ.

С его помощью можно проверить личность через официальный сервис , используя автомобильный номер в качестве начальных данных .

пробив с фото

Технология “Глаз Бога” автоматически обрабатывает информацию из множества источников , формируя структурированные данные .

Клиенты бота получают пробный доступ для ознакомления с функционалом .

Сервис постоянно обновляется , сохраняя актуальность данных в соответствии с требованиями времени .

Прямо здесь можно получить сервис “Глаз Бога”, позволяющий найти данные о гражданине из открытых источников.

Бот активно ищет по фото, анализируя актуальные базы в сети. С его помощью можно получить бесплатный поиск и полный отчет по имени.

Сервис проверен на 2025 год и охватывает аудио-материалы. Сервис гарантирует проверить личность в открытых базах и покажет информацию в режиме реального времени.

https://glazboga.net/

Данный инструмент — выбор в анализе граждан через Telegram.

Модульный дом https://kubrdom.ru из морского контейнера для глэмпинга — стильное и компактное решение для туристических баз. Полностью готов к проживанию: утепление, отделка, коммуникации.

Техника восстанавливается даже после сильных повреждений и залития.

¿Buscas cupones recientes de 1xBet? En este sitio encontrarás bonificaciones únicas en apuestas deportivas .

La clave 1x_12121 garantiza a un bono de 6500 rublos durante el registro .

Para completar, utiliza 1XRUN200 y recibe un bono máximo de 32500 rublos .

http://hotel-golebiewski.phorum.pl/viewtopic.php?p=578922#578922

Mantente atento las promociones semanales para conseguir recompensas adicionales .

Todos los códigos son verificados para hoy .

No esperes y multiplica tus ganancias con esta plataforma confiable!

шкаф машиноместо шкаф машиноместо .

сайт Кракен тор кракен даркнет

Обязательная сертификация в России критически важна для обеспечения безопасности потребителей, так как минимизирует риски опасной или некачественной продукции на рынок.

Процедуры проверки основаны на нормативных актах , таких как ФЗ № 184-ФЗ, и регулируют как отечественные товары, так и ввозимые продукты.

стоимость отказного письма Документальное подтверждение гарантирует, что продукция прошла тестирование безопасности и не угрожает здоровью людям и окружающей среде.

Также сертификация стимулирует конкурентоспособность товаров на глобальной арене и открывает доступ к экспорту.

Развитие системы сертификации учитывает современным стандартам, что укрепляет экономику в условиях технологических вызовов.

В этом ресурсе вы можете найти последними новостями страны и зарубежья .

Информация поступает ежеминутно .

Освещаются видеохроники с ключевых точек.

Аналитические статьи помогут получить объективную оценку.

Контент предоставляется бесплатно .

https://ulmoda.ru

This platform offers up-to-date information about Audemars Piguet Royal Oak watches, including retail costs and model details .

Explore data on popular references like the 41mm Selfwinding in stainless steel or white gold, with prices averaging $39,939 .

This resource tracks resale values , where limited editions can command premiums .

Audemars Royal Oak 15510st price

Technical details such as automatic calibers are clearly outlined .

Check trends on 2025 price fluctuations, including the Royal Oak 15510ST’s investment potential.

Professional concrete driveway installers seattle — high-quality installation, durable materials and strict adherence to deadlines. We work under a contract, provide a guarantee, and visit the site. Your reliable choice in Seattle.

Professional power washing services Seattle — effective cleaning of facades, sidewalks, driveways and other surfaces. Modern equipment, affordable prices, travel throughout Seattle. Cleanliness that is visible at first glance.

Professional seattle swimming pool installation — reliable service, quality materials and adherence to deadlines. Individual approach, experienced team, free estimate. Your project — turnkey with a guarantee.

Access detailed information about the Audemars Piguet Royal Oak Offshore 15710ST via this platform , including market values ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece showcases a robust design with automatic movement and water resistance , crafted in titanium.

Unworn AP Royal Oak Offshore Diver 15710st reviews

Check secondary market data , where limited editions reach up to $750,000 , alongside pre-owned listings from the 1970s.

View real-time updates on availability, specifications, and resale performance , with price comparisons for informed decisions.

Searching for latest 1xBet promo codes? Our platform offers verified promotional offers like 1x_12121 for new users in 2024. Get €1500 + 150 FS as a first deposit reward.

Use trusted promo codes during registration to maximize your rewards. Enjoy risk-free bets and special promotions tailored for casino games.

Discover monthly updated codes for 1xBet Kazakhstan with fast withdrawals.

Every voucher is checked for accuracy.

Grab exclusive bonuses like GIFT25 to increase winnings.

Active for new accounts only.

https://adk.audio/company/personal/user/1354/forum/message/6171/11013/#message11013

Enjoy seamless rewards with easy redemption.

Need transportation? ship my car to another state car transportation company services — from one car to large lots. Delivery to new owners, between cities. Safety, accuracy, licenses and experience over 10 years.

Нужна камера? купить мини камеру для видеонаблюдения для дома, офиса и улицы. Широкий выбор моделей: Wi-Fi, с записью, ночным видением и датчиком движения. Гарантия, быстрая доставка, помощь в подборе и установке.

Looking for exclusive 1xBet promo codes? Our platform offers working promotional offers like GIFT25 for registrations in 2024. Claim €1500 + 150 FS as a first deposit reward.

Use trusted promo codes during registration to boost your rewards. Benefit from no-deposit bonuses and exclusive deals tailored for casino games.

Discover monthly updated codes for global users with guaranteed payouts.

Every promotional code is tested for validity.

Grab exclusive bonuses like 1x_12121 to double your funds.

Active for new accounts only.

https://aboutnursinghomejobs.com/author/promocional3/

Experience smooth rewards with easy redemption.

Сертификация и лицензии — ключевой аспект ведения бизнеса в России, гарантирующий защиту от непрофессионалов.

Декларирование продукции требуется для подтверждения соответствия стандартам.

Для 49 видов деятельности необходимо получение лицензий.

https://ok.ru/group/70000034956977/topic/158859927337137

Игнорирование требований ведут к штрафам до 1 млн рублей.

Дополнительные лицензии помогает усилить конкурентоспособность бизнеса.

Соблюдение норм — залог успешного развития компании.

car transport vehicle car shipping estimate

Ищете подробную информацию для нумизматов ? Наш сайт предлагает исчерпывающие материалы для изучения монет !

Здесь доступны коллекционные экземпляры из исторических периодов, а также драгоценные предметы .

Изучите архив с характеристиками и детальными снимками, чтобы найти раритет.

золотые инвестиционные монеты Георгий Победоносец

Если вы начинающий или эксперт, наши статьи и гайды помогут углубить экспертизу.

Не упустите возможностью добавить в коллекцию лимитированные артефакты с гарантией подлинности .

Станьте частью сообщества ценителей и следите аукционов в мире нумизматики.

Хотите найти подробную информацию для нумизматов ? Наш сайт предлагает исчерпывающие материалы для изучения нумизматики!

У нас вы найдёте редкие экземпляры из разных эпох , а также драгоценные находки.

Просмотрите каталог с характеристиками и высококачественными фото , чтобы найти раритет.

золотой сеятель 2023

Для новичков или профессиональный коллекционер , наши статьи и руководства помогут углубить экспертизу.

Воспользуйтесь возможностью добавить в коллекцию эксклюзивные артефакты с сертификатами.

Станьте частью сообщества энтузиастов и следите аукционов в мире нумизматики.

https://www.biopedic.net/ products for quality rest

цена керамогранита за м2 цена керамогранита 60 на 120

biopedic.net/ rest with benefits

orthopedic base enhances mattress support

Профессиональное косметологическое оборудование аппараты для салонов красоты, клиник и частных мастеров. Аппараты для чистки, омоложения, лазерной эпиляции, лифтинга и ухода за кожей.

https://biopedic.net spine support

Launched in 1999, Richard Mille redefined luxury watchmaking with cutting-edge innovation . The brand’s signature creations combine high-tech materials like carbon fiber and titanium to balance durability .

Mirroring the precision of racing cars , each watch prioritizes functionality , optimizing resistance. Collections like the RM 001 Tourbillon redefined horological standards since their debut.

Richard Mille’s collaborations with experts in materials science yield ultra-lightweight cases tested in extreme conditions .

Certified Mille Richard RM67 02 models

Rooted in innovation, the brand pushes boundaries through bespoke complications for collectors .

With a legacy , Richard Mille remains synonymous with luxury fused with technology , appealing to global trendsetters.

Explore the iconic Patek Philippe Nautilus, a horological masterpiece that blends sporty elegance with refined artistry.

Launched in 1976 , this legendary watch redefined high-end sports watches, featuring signature angular cases and horizontally grooved dials .

For stainless steel variants like the 5990/1A-011 with a 55-hour energy retention to opulent gold interpretations such as the 5811/1G-001 with a blue gradient dial , the Nautilus suits both discerning collectors and everyday wearers .

Verified Patek Nautilus 5980r wristwatch

The diamond-set 5719 elevate the design with gemstone accents, adding unmatched glamour to the timeless profile.

With market values like the 5726/1A-014 at ~$106,000, the Nautilus remains a coveted investment in the world of premium watchmaking.

For those pursuing a historical model or contemporary iteration , the Nautilus embodies Patek Philippe’s legacy of excellence .

горячая консультация юриста юридическая помощь по телефону бесплатно

biopedic.net comfort for everyone

ultimate createporn AI generator. Create hentai art, porn comics, and NSFW with the best AI porn maker online. Start generating AI porn now!

Die Royal Oak 16202ST kombiniert ein rostfreies Stahlgehäuse von 39 mm mit einem extraflachen Gehäuse von nur 8,1 mm Dicke.

Ihr Herzstück bildet das automatische Manufakturwerk 7121 mit 55 Stunden Gangreserve.

Der smaragdene Farbverlauf des Zifferblatts wird durch das Petite-Tapisserie-Muster und die Saphirglas-Abdeckung mit Antireflexbeschichtung betont.

Neben klassischer Zeitmessung bietet die Uhr ein Datumsfenster bei 3 Uhr.

Piguet Royal Oak 15450 uhren

Die 50-Meter-Wasserdichte macht sie alltagstauglich.

Das geschlossene Stahlband mit verstellbarem Dornschließe und die achtseitige Rahmenform zitieren das ikonische Royal-Oak-Erbe aus den 1970er Jahren.

Als Teil der legendären Extra-Thin-Reihe verkörpert die 16202ST horlogerie-Tradition mit einem aktuellen Preis ab ~75.900 €.

КредитоФФ http://creditoroff.ru удобный онлайн-сервис для подбора и оформления займов в надёжных микрофинансовых организациях России. Здесь вы найдёте лучшие предложения от МФО

Стальные резервуары используются для сбора нефтепродуктов и соответствуют стандартам температур до -40°C.

Горизонтальные емкости изготавливают из нержавеющих сплавов с антикоррозийным покрытием.

Идеальны для промышленных объектов: хранят бензин, керосин, мазут или биодизель.

Резервуар РГС 40 м3

Двустенные резервуары обеспечивают экологическую безопасность, а подземные модификации подходят для разных условий.

Заводы предлагают типовые решения объемом до 500 м³ с технической поддержкой.

Ce modèle Jumbo arbore un boîtier en acier inoxydable ultra-mince (8,1 mm d’épaisseur), équipé du calibre automatique 7121 offrant une réserve de marche de 55 heures.

Le cadran « Bleu Nuit Nuage 50 » présente un motif Petite Tapisserie associé à des chiffres luminescents et des aiguilles Royal Oak.

Une glace saphir anti-reflets garantit une lisibilité optimale.

14790st

Outre l’affichage heures et minutes, la montre intègre une indication pratique du jour. Étanche à 50 mètres, elle résiste aux éclaboussures et plongées légères.

Le maille milanaise ajustable et la lunette octogonale reprennent les codes du design signé Gérald Genta (1972). Un boucle personnalisée assure un maintien parfait.

Appartenant à la série Jumbo historique, ce garde-temps allie innovation technique et esthétique intemporelle, avec un prix estimé à plus de 75 000 €.

Помощь юриста https://yuristy-ekaterinburga.ru

Этот сайт публикует интересные новости в одном месте.

Здесь можно найти события из жизни, бизнесе и других областях.

Новостная лента обновляется регулярно, что позволяет держать руку на пульсе.

Минималистичный дизайн ускоряет поиск.

https://icefashion.ru

Каждое сообщение оформлены качественно.

Редакция придерживается достоверности.

Оставайтесь с нами, чтобы быть на волне новостей.

онлайн займ моментально займ кредит на карту онлайн

Женский блог https://zhinka.in.ua Жінка это самое интересное о красоте, здоровье, отношениях. Много полезной информации для женщин.

¡Saludos, seguidores del éxito !

Casino online sin licencia con acceso desde mГіvil – https://casinossinlicenciaenespana.es/# casinos online sin licencia

¡Que vivas jackpots impresionantes!

Городской портал Черкассы https://u-misti.cherkasy.ua новости, обзоры, события Черкасс и области

Портал города Черновцы https://u-misti.chernivtsi.ua последние новости, события, обзоры

¡Hola, exploradores de recompensas !

Casino sin licencia con pagos inmediatos – http://www.casinossinlicenciaespana.es/ casino sin registro

¡Que experimentes logros excepcionales !

вызов нарколога на дом нижний вызвать нарколога на дом анонимно

Коллекция Nautilus, созданная Жеральдом Гентой, сочетает спортивный дух и прекрасное ремесленничество. Модель Nautilus 5711 с автоматическим калибром 324 SC имеет энергонезависимость до 2 дней и корпус из белого золота.

Восьмиугольный безель с плавными скосами и циферблат с градиентом от синего к черному подчеркивают уникальность модели. Браслет с H-образными элементами обеспечивает удобную посадку даже при повседневном использовании.

Часы оснащены индикацией числа в позиции 3 часа и сапфировым стеклом.

Для сложных модификаций доступны секундомер, лунофаза и индикация второго часового пояса.

patek-philippe-nautilus.ru

Например, модель 5712/1R-001 из красного золота 18K с калибром повышенной сложности и запасом хода до 48 часов.

Nautilus остается символом статуса, объединяя инновации и классические принципы.

кодировка от алкоголя в в новгороде кодирование от алкоголизма цены

нижний клиника лечения алкоголизма частные клиники лечения алкоголизма

вывод из запоя стоимость нижний новгород вывод из запоя на дому

http://biopedic.net guaranteed quality

Новинний сайт Житомира https://faine-misto.zt.ua новости Житомира сегодня

Праздничная продукция https://prazdnik-x.ru для любого повода: шары, гирлянды, декор, упаковка, сувениры. Всё для дня рождения, свадьбы, выпускного и корпоративов.

оценка предприятий оценка рыночной стоимости ооо

лечение наркомании диспансер лечение наркозависимости стационаре

Всё для строительства https://d20.com.ua и ремонта: инструкции, обзоры, экспертизы, калькуляторы. Профессиональные советы, новинки рынка, база строительных компаний.

Gambling has become an thrilling way to enhance your entertainment. Engaging with tennis, this site offers exceptional value for each user.

From live betting to early markets, access a broad selection of gambling options tailored to your interests. The easy-to-use design ensures that making wagers is both straightforward and secure.

https://gazetablic.com/new/?easybet_south_africa___sports_betting__casino___free_r50_bonus.html

Get started to experience the ultimate wagering adventure available digitally.

http://biopedic.net verified orthopedic effect

Строительный журнал https://garant-jitlo.com.ua всё о технологиях, материалах, архитектуре, ремонте и дизайне. Интервью с экспертами, кейсы, тренды рынка.

Онлайн-журнал https://inox.com.ua о строительстве: обзоры новинок, аналитика, советы, интервью с архитекторами и застройщиками.

Современный строительный https://interiordesign.kyiv.ua журнал: идеи, решения, технологии, тенденции. Всё о ремонте, стройке, дизайне и инженерных системах.

Информационный журнал https://newhouse.kyiv.ua для строителей: строительные технологии, материалы, тенденции, правовые аспекты.

http://biopedic.net/ solutions for all ages

¡Saludos, cazadores de fortuna !

Casino online extranjero con app para iPhone – п»їhttps://casinosextranjerosenespana.es/ casinos extranjeros

¡Que vivas increíbles victorias épicas !

Строительный журнал https://poradnik.com.ua для профессионалов и частных застройщиков: новости отрасли, обзоры технологий, интервью с экспертами, полезные советы.

Всё о строительстве https://stroyportal.kyiv.ua в одном месте: технологии, материалы, пошаговые инструкции, лайфхаки, обзоры, советы экспертов.

Журнал о строительстве https://sovetik.in.ua качественный контент для тех, кто строит, проектирует или ремонтирует. Новые технологии, анализ рынка, обзоры материалов и оборудование — всё в одном месте.

Полезный сайт https://vasha-opora.com.ua для тех, кто строит: от фундамента до крыши. Советы, инструкции, сравнение материалов, идеи для ремонта и дизайна.

biopedic.net/ rest with benefits

Новости Полтава https://u-misti.poltava.ua городской портал, последние события Полтавы и области

Кулинарный портал https://vagon-restoran.kiev.ua с тысячами проверенных рецептов на каждый день и для особых случаев. Пошаговые инструкции, фото, видео, советы шефов.

Мужской журнал https://hand-spin.com.ua о стиле, спорте, отношениях, здоровье, технике и бизнесе. Актуальные статьи, советы экспертов, обзоры и мужской взгляд на важные темы.

Журнал для мужчин https://swiss-watches.com.ua которые ценят успех, свободу и стиль. Практичные советы, мотивация, интервью, спорт, отношения, технологии.

Читайте мужской https://zlochinec.kyiv.ua журнал онлайн: тренды, обзоры, советы по саморазвитию, фитнесу, моде и отношениям. Всё о том, как быть уверенным, успешным и сильным — каждый день.

ИнфоКиев https://infosite.kyiv.ua события, новости обзоры в Киеве и области.

https://www.biopedic.net certified products

Монтаж оборудования для наблюдения обеспечит защиту территории на постоянной основе.

Инновационные решения позволяют организовать высокое качество изображения даже при слабом освещении.

Вы можете заказать широкий выбор устройств, адаптированных для дома.

videonablyudeniemoskva.ru

Грамотная настройка и консультации специалистов делают процесс максимально удобным для любых задач.

Обратитесь сегодня, и узнать о оптимальное предложение по внедрению систем.

Все новинки https://helikon.com.ua технологий в одном месте: гаджеты, AI, робототехника, электромобили, мобильные устройства, инновации в науке и IT.

Портал о ремонте https://as-el.com.ua и строительстве: от черновых работ до отделки. Статьи, обзоры, идеи, лайфхаки.

Ремонт без стресса https://odessajs.org.ua вместе с нами! Полезные статьи, лайфхаки, дизайн-проекты, калькуляторы и обзоры.

Сайт о строительстве https://selma.com.ua практические советы, современные технологии, пошаговые инструкции, выбор материалов и обзоры техники.

double orthopedic mattresses for better sleep

¡Hola, seguidores de la emoción !

Casino fuera de EspaГ±a con depГіsitos bajos – https://www.casinoonlinefueradeespanol.xyz/ casino online fuera de espaГ±a

¡Que disfrutes de asombrosas botes impresionantes!

Монтаж систем видеонаблюдения поможет защиту помещения в режиме 24/7.

Продвинутые системы гарантируют высокое качество изображения даже в темное время суток.

Мы предлагаем широкий выбор устройств, подходящих для бизнеса и частных объектов.

установка видеонаблюдения купить

Профессиональная установка и техническая поддержка обеспечивают простым и надежным для любых задач.

Обратитесь сегодня, чтобы получить оптимальное предложение для установки видеонаблюдения.

Городской портал Винницы https://u-misti.vinnica.ua новости, события и обзоры Винницы и области

¡Saludos, exploradores de tesoros !

Ranking de tragamonedas en casino online extranjero – https://www.casinoextranjerosenespana.es/ casinoextranjerosenespana.es

¡Que disfrutes de logros sobresalientes !

¡Saludos, exploradores de emociones !

casinosextranjero.es – tu portal de juegos online – https://www.casinosextranjero.es/ п»їcasinos online extranjeros

¡Que vivas increíbles jackpots extraordinarios!

Портал Львів https://u-misti.lviv.ua останні новини Львова и области.

Свежие новости https://ktm.org.ua Украины и мира: политика, экономика, происшествия, культура, спорт. Оперативно, объективно, без фейков.

Сайт о строительстве https://solution-ltd.com.ua и дизайне: как построить, отремонтировать и оформить дом со вкусом.

Авто портал https://real-voice.info для всех, кто за рулём: свежие автоновости, обзоры моделей, тест-драйвы, советы по выбору, страхованию и ремонту.

Новини Львів https://faine-misto.lviv.ua последние новости и события – Файне Львов